Looks like the long-awaited move to lower interest rates may have to wait a few more months. Last Sunday night on 60 Minutes, Chair Powell indicated the Fed will be waiting to pull the trigger on lowering rates. His message was that the Fed thinks the economy is in a good place and they think inflation is coming down. They just want to gain a little more confidence that it’s coming down in a sustainable way.

Ok, so the markets have already discounted the information that rates are coming down. However, the markets either don’t seem to take into account or blissfully ignore (specifically the equity markets!), Quantitative Tightening (QT), i.e., that the Fed is removing reserves from the system. GFMI has written about Fed tools to manage interest rates on several occasions.1 Before we take a take a look at Quantitative Tightening, let’s do a quick review on how the Fed implements monetary policy in a regime of “ample reserves”.

Ample reserves imply that there is enough money in the banking system to ensure that the Fed’s target for the Fed Funds rate (currently the target is 5.25-5.50%) is ample enough to keep the supply and demand of reserves in balance. Let’s review how this is done2:

- First, the Fed pays a rate of interest to banks for maintaining reserves with the Fed. This rate is known as Interest on Reserve Balances (IORB). The current rate is 5.40%. Banks keep reserves for a variety of reasons including, but not necessarily limited to, making payments, earning a high rate of interest on High Quality Liquid Assets (HQLA), and meeting any internal and regulatory liquidity requirements. This can be considered a floor for Fed Funds. Hence, the overall framework is sometimes referred to as a “floor” system.

- If the supply of reserves becomes too plentiful, then the rate in the Fed Funds market will fall. The Fed implemented the overnight reverse repurchase agreement (O/N – RRP) facility to assist when reserves might become too plentiful. Interestingly, this facility is opened to a wide variety of financial institutions and not just banks, but only banks can keep money at the Fed in the form of reserves. This keeps the Fed Funds rate from falling too much. The current rate on this facility is 5.30%. Note that both rates are within the target range for Fed Funds!

Clearly, banks would prefer to earn 5.40% on their investments versus 5.30%. If rates do move higher than the 5.40%, then banks would be incentivized to lend money in the Fed Funds or other markets. A few points here: first, banks still have to make payments and keep enough liquidity on hand. Second, as mentioned in a pervious article3, the Fed Funds market is no longer a very liquid market and is dominated by government sponsored enterprises. Further, banks would have to take into account the differences in capital requirements and other regulatory requirements in the type of assets they invested in as opposed to simply keeping their money with the Fed.

These interest rates, IORB and O/N Reverse Repo, are referred to as “administered” rates.

Which brings us back to QT. QT, sometimes referred to as balance sheet nomalization4, removes money or more specifically, excess liquidity from the banking system. Recall quantitative easing (QE), which the Fed implemented after the ’08 crisis, is the opposite of QT. QE adds liquidity to the banking system while QT removes excess liquidity.

To achieve the goal of QT, the Fed either sells Treasury securities and agency debt/MBS or they allow the Treasurys and agency debt/MBS they currently own to mature without reinvesting the proceeds. The Fed has placed limits on the amount they will not renew: $60 billion for Treasurys and for agency debt and $35 billion for agency mortgage-backed securities. In other words, any amount of maturing debt above these limits, and the Fed will reinvest those proceeds. (For more detail go to https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm.)

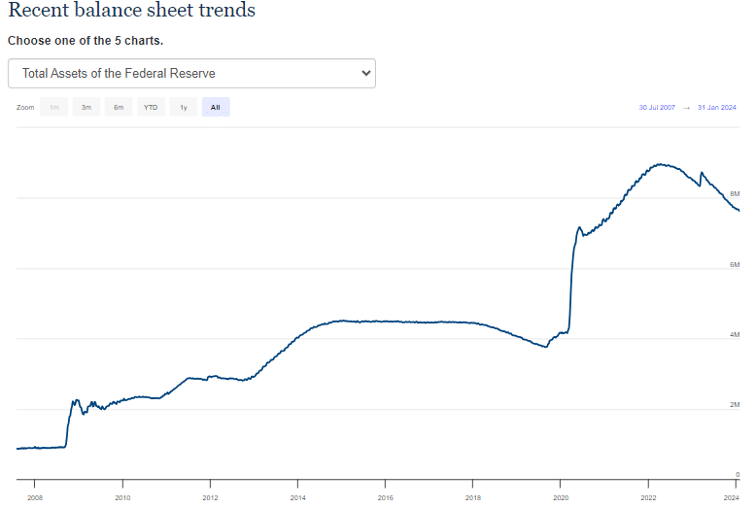

The Fed’s balance sheet has dropped significantly since it peaked in Aprill 2022 at almost $9 trillion (If you are not sure of the number, it is $9,000,000,000,000!). Today it stands at approximately $7.7 trillion. This is an estimated drop of $1.3 trillion. The following chart shows the trend in the Fed’s balance sheet:

The question to ask is if QT is tightening, how much does the reduction in the balance sheet equate to in interest rates? This is not an easy question to answer. Here are a couple of estimates:

- $1.5T reduction = approximate increase of 1.00%5

- $2.5T reduction = approximate increase of 0.50%6

The bottom line, QT removes excess liquidity and can have an impact on interest rates. While the reduction of the Fed’s balance sheet from its peak to its current size has happened over a period of time, the impact is nevertheless to lessen liquidity in the market and is a form of tightening monetary policy. Although the increase in rates is not transparent, it is still a very real issue. This brings up two points:

- If the Fed reaches their 2% goal for inflation, will they cut the Fed Funds rate more than the market is expecting to offset QT? On the other hand, if inflation doesn’t come down to the 2% level, will the Fed leave rates at their current levels but continue to reduce the balance sheet? Or do market participants even care about QT and only focus on Fed Funds?

- The other issue is market liquidity. The Fed discovered in September 2019 that there were not sufficient amounts of reserves in the banking system and Fed Funds, along with SOFR, spiked7,8. At that point bank reserves were 7% of GDP. As of August 2023, right after the reginal banking crisis, bank reserves were 13% of GDP9. That is a wide range and the Fed will reassess the optimal amount of bank reserves on an ongoing basis.

In the end, bank reserves are dynamic. The Fed will continue QT to find the right amount of bank reserves that balances supply and demand in the markets. Hopefully, we will not see another September 2019 episode and the Fed’s balance sheet gets back to “normal”. This will be important because it is a key tool in managing the next crisis that will inevitably crop up in the future. In the meantime, market participants will have to get used to, if they haven’t already, the ample reserve framework, the Fed’s balance sheet as a monetary policy tool and administered rates.

Footnotes

https://www.gfmi.com/articles/the-federal-reserves-tools-to-manage-monetary-policy/

https://www.gfmi.com/articles/the-federal-reserve-tools-past-and-present/

2 For more in depth information on this topic see https://www.federalreserve.gov/econres/notes/feds-notes/implementing-monetary-policy-in-an-ample-reserves-regime-the-basics-note-1-of-3-20200701.html

3 See https://www.gfmi.com/articles/the-federal-reserves-tools-to-manage-monetary-policy/

4 For a more in depth article on this topic go to The Mechanics of Fed Balance Sheet Normalization | St. Louis Fed (stlouisfed.org)

5 See The Fed Is Now Shrinking The Balance Sheet By $95 Billion A Month | Bankrate

7 See https://www.gfmi.com/articles/reflections-on-recent-volatility-in-the-repo-markets/

9 See footnote 4