The repo markets in the United States have historically been a relatively obscure but highly important part of the “plumbing” of the capital markets by facilitating overnight and generally, short-term financing of securities transactions primarily in the US Treasury market. Repos are also a key provider of short-term liquidity to US brokerage firms facilitating both the purchase and sale of US Treasury and Agency securities, as well as trading of other corporate bonds. (For an explanation of repos and SOFR, please go to https://www.gfmi.com/articles/libor-schmibor-whats-next-sofr-part/.)

Historically, these markets functioned efficiently and with little publicity within the professional trading sphere, but gained wide notoriety in the market collapse of 2008 when clearing banks accepted large amounts of non-agency mortgage-backed securities as collateral (as opposed to Treasury securities), and the collapse of those securities led to the freezing of repo clearing by banks such as JP Morgan and BNY Mellon. This, in turn, contributed to the demise of firms such as Lehman Brothers.

In the ensuing years, the US Tri-Party Repo Infrastructure Reform Program largely mitigated the intraday settlement risk in the tri-party repo market but left unresolved the risk of “fire sales”, i.e., the panic selling of an asset class of securities across the market. Daily repo volume, which was up to $6 trillion before the 2008 crisis, resumed at a lower level of up to $4 trillion after the 2008 crisis and the consequent repo market reforms.

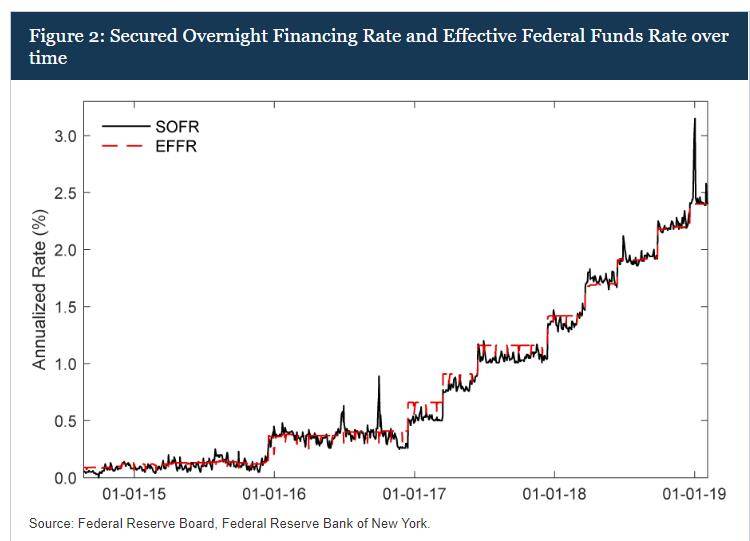

Historically, repo rates have generally moved in concert with other short-term USD interest rates, such as overnight Fed Funds. Prior to the crisis, overnight repos tended to trade below overnight fed funds because they were collateralized. However, since the crisis and the introduction of interest on excess reserves (IOER) and various new banking regulations, this relationship is no longer valid. For reference, the Graph 1 shows the average Fed Funds rate, commonly referred to as the Effective Federal Funds Rate or EFFR, going back to 1996. Graph 2 shows the repo rate going back to 2005. And Graph 3 shows the EFFR versus SOFR, which is an index based on repos. Graph 3 clearly shows the volatility of SOFR compared to the EFFR.

Graph 1

Source: https://fred.stlouisfed.org/series/FEDFUNDS

Graph 2

Graph 3

A Recent Spike in the Repo Markets

Graph 2 clearly shows spikes in the repo market. Specifically, around September 17 of 2019, repo rates spiked to a somewhat incredible level of 10%. This prompted the Fed to provide liquidity via the repo market, pumping cash into banks and broker-dealers.

In order to convey a picture of how the market spike arose and to capture some of the real-time market reaction to events as they unfolded, we have reprinted some tweets from September and October 2019 by market participants, particularly Scott Skyrm, EVP, of Curvature Securities, who is a participant in the repo market.

Sep 13 – Scott Skyrm@ScottSkyrm: Feels like there is less cash in the Repo market. Maybe cash that came in August with the market rally is starting move out. Maybe Money Market Fund cash was reallocated into other investments. Maybe the constant trickle of new issuance is finally starting to absorb the cash.

Sep 16 – Scott Skyrm@ScottSkyrm: The market is still expecting a 25 bp ease on Wednesday with the fed funds rate moving from 2.13% down to 1.88% each day, but another ease in no longer guaranteed in October. According to the fed funds futures contracts the next ease is priced by the end of the year.

Sep 16 – zerohedge: “Something Just Snapped: Chaos Hits Repo Market As “Funding Storm” Makes Thunderous Landfall One day is not a big deal, if funding pressures persist, it implies a loss of control of funding markets.”

Sep 18 – Monday Morning Macro: 99th percentile for SOFR printed an incredible 9.00%. one quarter of all transactions above 5.85%. Now consider that column with “total volume”= $1,177 Billion. (flames icon) Don’t worry though, @federalreserve totally got this one under control…

The following table shows SOFR and the percentiles on the respective dates:

NB: Although repo rates hit 10%, SOFR is not the same as the repo rate. It is a defined composite of different segments of the repo market adjusted to remove “specials” from the rate calculation in order to make it an acceptable and suitable substitute for Libor as the basis for loan and derivatives pricing once Libor ceases to exist. Further, it is a median and not an average.

Sep 18 – Scott Skyrm@ScottSkyrm: I believe there is something bigger going on in the Repo market. There is either a large block of cash missing from the market or some blockage in the system that no one knows about. At least not yet!

Sep 18 – Scott Skyrm@ScottSkyrm: Tax date, $19B net issuance, market sell-off, $20B less MMF cash all reasons for funding pressure. But only like 10 to 15 bps. Those are factors that are all a part of the normal day-to-day ups and downs of the Repo market. They don’t explain how O/N rates can get to 9.25%.

Sep 18 – Scott Skyrm@ScottSkyrm: There was plenty of cash in the Repo market the past 2 days. It’s just not there in the morning when everyone is funding their long positions. Both mornings, the sellers overwhelmed the buyers, hitting bids like crazy and pushing rates higher and higher, but GC closed at 2.30%

Sep 19 – Scott Skyrm@ScottSkyrm: I believe GC Repo rates will remain volatile through next week, maybe through the end of the month. Let’s not even discuss quarter-end yet. That will be a whole topic in itself.

Oct 1 – Scott Skyrm@ScottSkyrm: Some questions to ponder about the Repo market: What if the Fed did not provide Q/E liquidity? Where would rates have gone? What is the Fed’s plan to remove the term liquidity from the market? Or do they plan on perpetually providing overnight operations going forward?

Oct 4 – Scott Skyrm@ScottSkyrm: Year-end GC Repo was 3.95%-3.85% earlier this week, but it’s lower now. It’s now quoted 3.75%-3.35%. Naturally, the Fed will be diligent to pump plenty of extra liquidity into the market. I expect the Fed will announce a schedule of overnight and term operations in early December. NB: A year-end repo market generally arises in the last few months of the year as companies begin to ready their year-end balance sheets.

Oct 4 – Scott Skyrm@ScottSkyrm: Pretty soon year-end Repo (12/31-1/2) will be the elephant in the Repo room. Meaning – everything beginning in December – credit lines, term trades, Fed operations, etc. will be about year-end.

The Fed’s Response

The Fed’s response to the repo spike of September 17, 2019 was to provide massive liquidity to the repo market by buying Treasuries from dealers in the form of reverse repo agreements. The Wall Street Journal reported on Thursday, September 19 that the Fed had added $75 billion to the financial system in its third repo transaction of the week as financial firms “scrambled for overnight funding. The actions marked the first time since the financial crisis that the Fed had taken such actions.”1 Counting the other cash infusions and term repos up to 14 days, total Fed intervention over two weeks was $165 billion.

Even though the Fed has acted quickly to address the lack of liquidity at the root of the spike to 10% in the repo market, the fact that such a dramatic event occurred in the first place is enough to cause continuing concerns among market participants even with the Fed announcing term repos over year-end.

One strategy to take advantage of future spikes was underscored in a recent article, addressing the Janus Short Duration Income exchange-traded fund, which according to the article, usually keeps up to 5% of its holdings in cash. Its manager, James Maroutsos, is quoted as saying, “The way to take advantage of this is you have to be cash-rich. … Dollars will be in high demand, so managers that have large amounts of dollars will be able to benefit probably.”2

Reflections on the Repo Spike and Libor/SOFR Transition

Several observations come to mind as we consider this sudden and unexpected crunch in the repo markets.

- Fire sales remain a concern, as there is still little progress on moving transactions through central counterparty clearinghouses. Although DTCC is spearheading an effort to promote central clearing; large money funds may not participate as a result of regulatory mandates. The fire sales of the financial crisis are still vividly remembered, but one wonders if the next one may take a stealthier and more unexpected path.

- JP Morgan Chase & Co. exited the tri-party repo settlement and clearing business, leaving BNY Mellon as the only provider of such services. Relying on a single institution has to be less than optimal in terms of risk management, e.g., systems failure, cybersecurity, and the like.

- As the recent repo rate spike demonstrated, such events can occur even though the Fed may be standing by to quickly ease the pain.

- A repo spike and its effect on SOFR would have an impact far beyond the repo market once SOFR replaces Libor as the reference rate governing the rate of interest on trillions of USD loans, securities, and derivative contracts.

- The markets in forward rates for SOFR are still in the early stages of development, but are crucial for determining prices for longer-term derivative and other financial instruments which will be tied to SOFR. Severe rate instability has to be a meaningful constraint of those forward markets, as well as the central role of the Fed in directly determining the level of SOFR.

There is still a long way to go with the LIBOR transition to SOFR!

References

1 The Wall Street Journal: Fed Adds $75 Billion to Financial System in Third Repo Transaction This Week, Daniel Kruger, September 19, 2019

2 Bloomberg: Fearing Another Repo Spike, Janus Builds Up Its Cash Pile, Katherine Greifeld and Alex Harris, November 6, 2019

About the Author: Charles Gates

Charles Gates is a Managing Director at eDelta Consulting and has over 30 years’ experience in investment and commercial banking, derivatives, foreign exchange, capital markets, hedge funds, and credit, market and operational risk management consulting. As a consultant and trainer, he has developed and presented learning events worldwide with many major investment banks, insurance firms, international banks, and regulatory agencies.

Charles began his career as a multinational lending officer for Citibank, after which he became a founder of Citi’s derivatives business. He completed many “first time” derivatives transactions for Citi, including its first interest rate swap in the United States, and helped the World Bank develop its swap program. Subsequently, he was global head and a founder of First Chicago’s currency swap business, SG Warburg’s international private placement and gold advisory, and Rabobank’s credit derivatives business, completing over $12 billion in credit derivative transactions. Charles served as Co-Head of the Credit Risk Management practice of Deloitte & Touche, an SVP of FRM (a premier global fund of hedge funds now part of Man Group), and a Managing Director of Grammer and Co. He has completed multiple expert witness assignments.

Charles has been a talent development professional throughout his career, covering topics such as credit analysis, process and presentation skills, capital markets and derivatives across the major asset classes of interest rates, foreign exchange, equities, commodities, hedge funds and credit (credit derivatives). He has taught client relationship building and marketing, leadership development, and is an executive coach, and a career coach at Columbia Business School.

He wrote “Building the Organization to Support the 130/30 Opportunity” for the prime brokerage consultancy of a major US investment bank, published in the Journal of Investing, and has been featured in Euromoney magazine.

Charles is a member of GARP, FIASI, and ATD. He holds an MBA, cum laude, from Columbia Business School, and a BA, cum laude, from Yale.

Copyright © 2019 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

Download article My Cart

My Cart