The LIBOR manipulation scandal has led regulators to recommend new money market benchmarks. This article briefly reviews LIBOR and what the potential replacements will be.

LIBOR

LIBOR, or London Inter-Bank Offered Rate, is a money market benchmark/index, less than one-year, that has been used throughout the financial/capital markets since 1986. Some products or instruments that use LIBOR as the benchmark include bank loans, floating rate notes, and, probably most extensively, derivative products such as interest rate swaps and futures. There are over $350 trillion of financial instruments that are tied to LIBOR. LIBOR itself is not a transacted oriented benchmark/index, but a survey that was conducted by the British Bankers Association (BBA) and is now conducted by ICE Benchmark Administration (IBA) (https://www.theice.com/iba/libor).

IBA essentially surveys different banks and asks for their lending rates to other banks from overnight out to one-year. IBA then takes an average of all the responses for each respective time period while removing some “tails” from both ends of the survey, i.e., the highest and lowest responses. These responses were in some sense guesstimates as the banks did not really lend money to one another. Since the responses from banks were manipulated to suit their positions, regulators have chosen to replace LIBOR with an, ideally, more transaction-oriented benchmark. In addition, LIBOR is a non-secured lending rate, i.e., the lender hopes to get their money back at maturity!

Replacements

Various countries have made different recommendations, which are discussed below. Sometimes the new lending rate is referred to as risk-free; however, this term is often associated with government debt, so the replacement may not be truly risk-free.

In the United States, the AARC (Alternative Reference Rates Committee1) has recommended three different overnight Treasury Repo rates. In Part II of this article, we will review the definitions of these three rates. But first, what exactly is a repo?

What is a Repo?

Repurchase agreements (repos) are contractual agreements. For example,

- Assume Bank A (sometimes referred to as a counterparty) agrees to sell a security to Bank B (also referred to as a counterparty) in exchange for cash

- Then Bank A buys back the security, under the same agreement, from the same counterparty, on some future date, and returns the cash plus interest.

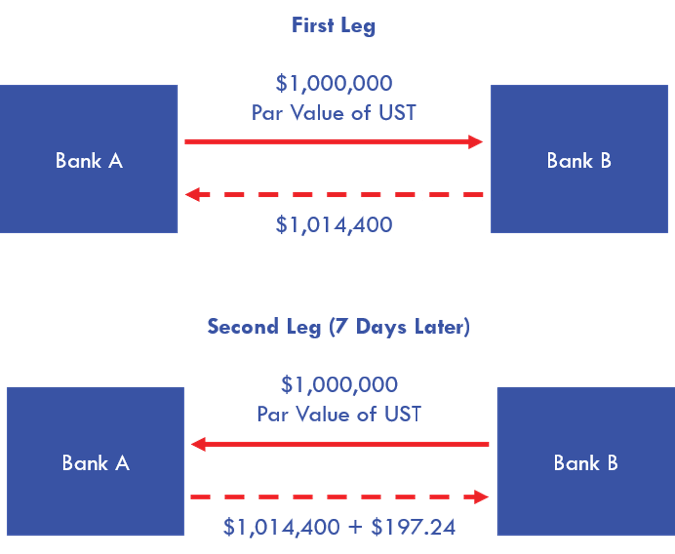

Let’s assume a U.S. Treasury is trading at a dirty price of 101.44 and the face amount is $1,000,000. The two counterparties agree on a borrowing rate of 1.00% for 7 days. The transaction can be broken down into two parts, commonly referred to as “legs”:

- First leg – Bank A sells the security to Bank B and borrows $1,014,400.

- Second leg – Bank A purchases the security back, and returns the cash plus interest, or 1,014,400 + 197.24 (1,014,400 x .01 x 7/360). Figure A illustrates the cash and security flows for both the first and second legs.

Figure A: Security and Cash Flows of Repurchase Agreement

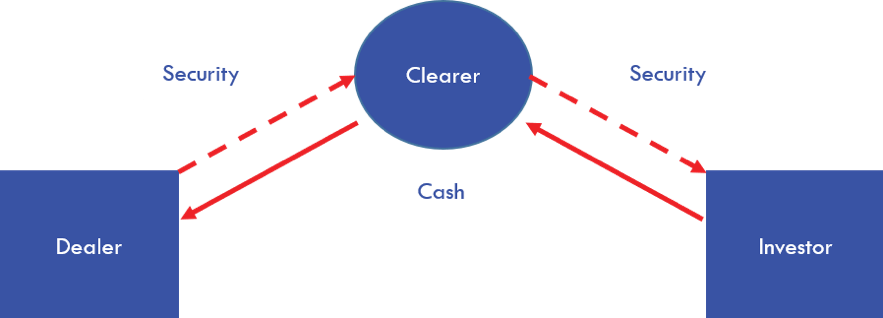

The above transaction is referred to as a bilateral transaction. Repo transactions can also be set up as a tri-party repo. Specifically, the two counterparties will use a third party, often known as a clearer, to administer the transaction. Figure B illustrates the initial security and the cash flows. In the U.S., Bank of New York Mellon is the clearer as J.P. Morgan, who was also a clearer, has decided to exit the business.

Figure B: Tri-Party Security and Cash Flows

The new Treasury repo rates will use a combination of the two types of transactions plus a third type known as General Collateral Financing (GCF) repo. (For more granular detail on how the rate is calculated, please see footnote 2 as well as Part II of this article.)

Note that, in practice, the lender of the cash will take a haircut, i.e., lend a lower amount of money. Generally speaking, it will be 1–3% less. This practice protects the lender of the cash in the event that the borrower goes bankrupt during the borrowing period and the security loses value. If this scenario does happen, the lender of the cash could then sell the security and recoup the amount lent to the now-bankrupt borrower.

The USD LIBOR market currently has a deep futures market for 3-month LIBOR. From this market/instrument it is possible to create synthetic rates for different maturities. Given the fact it is quite a liquid market, practitioners deem it to be a fair representation of the given maturity. One challenge for the new rate will be whether the markets deem this broad repo rate to be substantial enough to accurately reflect the potential benchmark for different maturities out to one year. The following table shows the maturities for bilateral repos only3:

| Maturity | Principal Weighted Share (Percent) U.S. Treasuries |

| Open | 20.2 |

| Overnight | 32.0 |

| 1-7 days | 13.1 |

| 7-30 days | 15.4 |

| 30 days to 1 year | 18.8 |

| Greater than 1 year | 0.4 |

According to the Fed4, the combined markets have a daily volume of several hundred billion dollars. So, there might be enough there to meet market requirements or a new futures market might be required (assuming it can garner the same amount of liquidity as the current 3-month Eurodollar futures market). Time will tell; the Federal Reserve is scheduled to begin publishing the three new Treasury rates sometime in the first half of 2018. (UPDATE: The Federal Reserve began publishing the new rates in the second quarter of 2018.)

International Benchmarks

Here is a sampling of proposed international benchmarks:

- In the U.K., SONIA (Sterling Overnight Index Average) is the winner. This is an unsecured rate taken from overnight lending. However, there is an OIS swap market and rates for different maturities can be taken from actual transactions5.

- In Switzerland, SARON® (Swiss Average Rate Overnight) will replace TOIS (Tomorrow/Next Overnight Indexed Swaps). This is based on repo rates and goes out 12 months6.

- Stay tuned: Europe is still to be determined!

Looking Ahead

The rationale and the impact of such changes take time to be researched and examined. And practical arguments and defense for LIBOR’s potential replacement will need to be heard. The U.S. three new rates must run parallel with LIBOR for a few years in order to establish the compensating credit spread between the two, so it appears that there is a good amount of time to find the proper replacement7.

References

1For the Federal Reserve announcement please go to: https://www.newyorkfed.org/medialibrary/microsites/arrc/files/2017/ARRC-press-release-Jun-22-2017.pdf

2The actual rate is a bit more complex. For the actual rate please see the Fed blog: https://www.newyorkfed.org/markets/opolicy/operating_policy_170524a

3OFR Brief Series – “The U.S. Bilateral Repos Market: Lessons from a New Survey” January 13, 2016: https://www.financialresearch.gov/briefs/files/OFRbr-2016-01_US-Bilateral-Repo-Market-Lessons-from-Survey.pdf

4FEDS Notes “The Cleared Bilateral Repo Market and Proposed Repo Benchmark Rates” February 27, 2017: https://www.federalreserve.gov/econresdata/notes/feds-notes/2017/cleared-bilateral-repo-market-and-proposed-repo-benchmark-rates-20170227.html

5For more information go to:http://www.bankofengland.co.uk/publications/Pages/news/2017/033.aspx

6For more information go to:http://www.six-swiss-exchange.com/indices/data_centre/swiss_reference_rates/reference_rates_en.html

7For more information go to:

About the Author: Kenneth Kapner

He has been a Risk Management Advisor to a Mutual Fund’s Board of Trustees and has served as an Expert Witness using knowledge of derivatives, trading and risk management.

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Copyright © 2018 by Global Financial Markets Institute, Inc.