Since 2008, much has changed in regards to how the Fed manages monetary policy/interest rates. We might even say “what a long strange trip it’s been.” A lot has transpired since the credit crisis in 2008, up to and including the 2020 COVID outbreak. In 2015, I wrote an article titled “The Federal Reserve Tools: Past and Present” (https://www.gfmi.com/articles/the-federal-reserve-tools-past-and-present/). This current article looks at the Fed’s current tools, including Fed Funds, reserve requirements, interest paid on reserves, quantitative easing/large asset purchases, open market operations, and transparency. But first let’s start with the Federal Reserve’s congressionally mandated goals.

The Federal Reserve Mandates

The Federal Reserve has two mandates: full employment and price stability. The latter is code for keeping inflation under control. The Fed’s current long range inflation goal is 2%.1 Defining full employment is more challenging. In a speech given in February 2021, Fed governor Lael Brainard stated:

“The new framework calls for monetary policy to seek to eliminate shortfalls of employment from its maximum level, in contrast to the previous approach that called for policy to minimize deviations when employment is too high as well as too low. The new framework also defines the maximum level of employment as a broad-based and inclusive goal assessed through a wide range of indicators.”2

The new framework being referred to was a comprehensive and public review of monetary policy. Bottom line: There is plenty of room for interpretation.

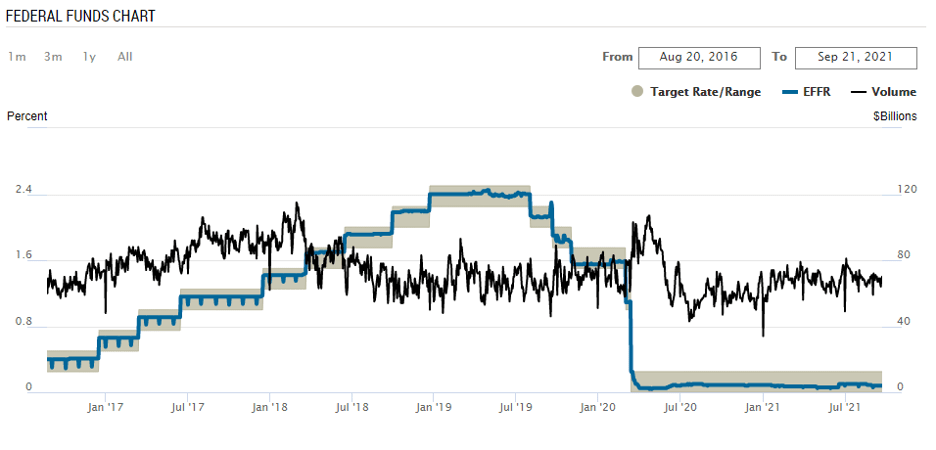

Federal Funds/Fed Funds

According to the Fed’s website, “The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.”3 I always referred to it simply as “fed funds.” Today it is commonly referred to as the Effective Fed Funds Rate, or EFFR. The vast majority of transactions mature overnight. Again citing the Fed’s website, “The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions.”3 The Government Sponsored Enterprises, or GSEs, referred to above is dominated by the Federal Home Loan Banks, which are the main lenders in this market. Regardless of participants, the Fed uses overnight fed funds as their main tool in managing interest rates. Specifically, the fed funds target is the rate that “keeps the economy on an even keel when employment and inflation are close to their objectives.”4 The current target rate/range is 0.00 – 0.25%. The following chart shows the historical range, the EFFR and the volume of fed funds.

Reserve Requirements

Effective March 26, 2020, the Federal Reserve eliminated reserve requirements for all depository institutions.5 Specifically, the reserve requirements were set to zero. By doing this, the Fed can reimpose reserve requirements if they deem it necessary.

Interest on Reserve Balances (IORB)

Prior to 2008, the Fed did not pay interest on reserves. As a result of a 2008 act of Congress, the Fed was permitted to pay interest on reserves, and started doing so on reserve accounts as of October 1, 2008.6

Since the Fed still had reserve requirements, they broke down the interest between interest on required reserves (IORR) and interest on excess reserves (IOER). Effective July 28, 2021, the Fed eliminated IORR and IOER which leaves us with IORB. Don’t you love acronyms!

As of October 4, 2021, IORB is 0.15%.

Large Asset Purchases/Quantitative Easing

Large asset purchases, commonly called quantitative easing (QE), plays a crucial role in keeping interest rates low. The Fed purchases both U.S. government notes/bonds and agency mortgage backed securities (MBS). This, in turn, keeps interest rates low. Keeping interest rates low, in theory, will help the Fed achieve their dual mandate. The Fed announces their guidance on upcoming purchases during their Federal Open Market Committee (FOMC) meetings.

Open Market Operations: Repos and Reverse Repos

Another tool the Fed uses to manage the fed funds target are repurchase agreements or, simply, repos and reverse repurchase agreements. (To better understand how repos work please go to https://www.gfmi.com/articles/libor-schmibor-whats-next-sofr-part/.)

Repos come under the Fed’s heading of open market operations. In a repo transaction, the Fed lends cash to a counterparty, traditionally a primary dealer7, and receives collateral, which is usually a U.S. Treasury. The transaction is reversed the next day and the borrower of the cash pays interest upon the maturity. The act of lending cash creates or adds money temporarily in the financial system. The Fed will execute this transaction to help stabilize the fed funds rate or, in extreme cases, help to bring it within its target range. For example, if fed funds are above the target range, the Fed will use repos to bring down the rate.

A reverse repo (sometimes referred to as matched sales) achieves the opposite goal and removes money temporarily from the financial system. In a reverse repo, the Fed borrows money and delivers collateral to the counterparty. At a later date, most often the next day, the transaction is reversed. In this case, the Fed pays interest for the use of funds. Similar to repos the Fed will execute this transaction to help stabilize the fed funds rate or in extreme cases, help to bring it into its target range. And, if fed funds have fallen below the target range, the Fed will use reverse repos to bring up the rate.

To be clear, most of these transactions have an overnight maturity.

Standing Overnight Repurchase Agreement Facility (SRF)

On July 28, 2021, the Fed instituted a standing repo facility. This is a form of repo transaction, but has daily parameters. For example, as of October 4, 2021, the total operation is set at $500 billion and a minimum bid rate of 0.25%. It is a standing facility because it can be used by counterparties on any date. This is opposed to traditional repos which the Fed initiates. The Fed “established the SRF to serve as a backstop in money markets to support the effective implementation and transmission of monetary policy and smooth market functioning.”8

The Discount Window and Discount Rate

Depository institutions may borrow money from the Fed on any given business day. The Fed lends money via their lending facility known as the discount window9 to depository institutions at the discount rate. Each borrowing is secured by collateral. The maturity may be up to 90 days and continuously renewed.

There are three interest rates associated with the discount rate. The Fed has various requirements to borrow at the primary credit rate (these are not discussed here but can be found at https://www.frbdiscountwindow.org/).

The Primary Credit Rate is correlated to levels of the fed funds rate and is currently 0.25%. Interestingly, the Fed only recently (in March 2020) made the change to have the primary rate reflect the general level of interest rates. Generally speaking, it has been higher than fed funds. In their March 15, 2020, news release, the Fed stated:

“Narrowing the spread of the primary credit rate relative to the general level of overnight interest rates should help encourage more active use of the window by depository institutions to meet unexpected funding needs.”10

The Secondary Credit Rate is usually 50 bps higher than the primary rate and as of October 4, 2021is 0.75%.

Seasonal Credit Rate is a viable for community banks to manage seasonal flows and as of October 4, 2021is 0.10%.

Historically, market participants viewed borrowing from the Fed as a last resort. It implies that firms borrowing from the Fed cannot borrow money in the open market, that is, they are having liquidity problems.

According to the Fed’s website:

“By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses.”11

As a side note, when reference is made to the “discount rate,” it generally refers to the primary credit rate.

Transparency/Forward Guidance

Historically, the Fed was not known for communicating or guiding market participants on their intentions for monetary policy. According to Nelson:

“Forward guidance—the issuance by a central bank of public statements concerning the likely future settings of its policy instruments—is now a key aspect of monetary policy in the United States…, limited moves toward the inclusion of forward guidance in the Federal Open Market Committee’s (FOMC) post meeting policy statements occurred in 2003 and 2004. The regular incorporation of forward guidance into FOMC post meeting statements began in 2008.”12

Starting in 2015, the Fed started to include an implementation note along with the FOMC statement: “The implementation note provides important details about how the Federal Reserve’s policy tools are being used to keep the federal funds rate in the target range established by the FOMC. This information should help increase public awareness and understanding about the normalization of monetary policy.”13

Conclusion

Certainly, the Fed has many tools at their disposal to influence interest rates. As a result, market participants spend a lot of time and energy interpreting the impact on the financial markets. While the tools we have discussed are not the only ones the Fed uses, they are, in my opinion, the main tools that the market follows.

With the COVID-19 pandemic still affecting the economy, market participants will be watching the Fed’s upcoming moves with great interest.

References

2 See https://www.federalreserve.gov/newsevents/speech/brainard20210224a.htm

3 See https://www.newyorkfed.org/markets/reference-rates/effr

4 See Reference 1

5 See https://www.federalreserve.gov/monetarypolicy/reservereq.htm

6 See https://www.federalreserve.gov/monetarypolicy/reserve-balances.htm

7 To understand the various counterparties with whom the Federal transacts, go to https://www.newyorkfed.org/markets/counterparties

8 See https://www.newyorkfed.org/markets/repo-agreement-ops-faq

9 According to Wikipedia, the term discount window “…originated with the practice of sending a bank representative to a reserve bank teller window when a bank needed to borrow money.” https://en.wikipedia.org/wiki/Discount_window

10 See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm

11 See https://www.federalreserve.gov/monetarypolicy/discountrate.htm

12 See https://www.federalreserve.gov/econres/feds/files/2021033pap.pdf

About the Author: Kenneth Kapner

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

He has been a Risk Management Advisor to a Mutual Fund’s Board of Trustees and has served as an Expert Witness using knowledge of derivatives, trading and risk management.

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Publications and Articles

Articles

2019 3-Month SOFR Futures

2019 LIBOR Schmibor: What’s Next? SOFR Part I and Part II

2018 VIX, Volatilities, and Exchange Traded Products

2018 Settlement Risk and Blockchain

2017 Electronic Trading and Flash Crashes – Part I and Part II

2016 The Long and Short of IT: An Overview of XVA

2016 The Long and Short of IT: An Overview STACR and CAS

2016 The Federal Reserve Tolls: Past and Present

2016 The Perfect Storm: October 2008

2016 Interest Rate Swap Futures: An Introduction

2014 Risk Reversals

2002 Futures Magazine, Doing Your Homework on Individual Equity Futures (Co-written with Robert McDonough)

Blog

Ken also edits and writes for the GFMI Blog.

Books

1996 Como Entender Los Swaps, (co-author: John Marshall), published by CECSA (a Mexican publishing firm). This is a translated edition of our book Understanding Swaps, but with adaptations to fit the Mexican markets. (289 pages)

1993 The Swaps Market: 2nd edition, Kolb Publishing, 288 pages (co-author: John Marshall, copyright 1993). This book is directed to the graduate business student.

1993 Understanding Swaps, John Wiley & Sons, 270 pages (co-author John Marshall, copyright 1993). This book is directed to the practitioner market and is published as part of Wiley’s Finance Series.

1993 1993-94 Supplement to the Swaps Handbook, New York Institute of Finance, a Simon & Schuster Company, 494 pages, (co-authors John Marshall and Ellen Lonergan, copyright 1993). This book is directed to a practitioner audience and is a supplement to The Swaps Handbook. My role was largely that of editor.

1991 1991-92 Supplement to The Swaps Handbook, New York Institute of Finance (Simon & Schuster Professional Information Group), 300+ pages (co-author: John Marshall copyright 1992). This book is directed to a professional practitioner audience and is an annual supplement to The Swaps Handbook.

1990 The Swaps Handbook: Swaps and Related Risk Management Instruments, New York: New York Institute of Finance, a Simon & Schuster Company, 543 pages. (co-author: John Marshall). This book is directed to derivative product professionals.

1988 Understanding Swap Finance, Cincinnati: South Western publishing Company, 155 pages. (co-author John Marshall, copyright 1990). This was the first academic text published on the swaps markets.

Copyright © 2021 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

My Cart

My Cart