The Federal Reserve Tools: Past and Present

Pundits all seem to agree that, later this year, the Federal Reserve will finally raise rates. Some seem to think that will occur in June while others believe it will be September. Regardless of when it happens, now would be a good time to review how the Federal Reserve actually goes about raising rates. This article reviews the Federal Reserve’s role, how they control the Fed Funds rate, and the tools used to accomplish these goals; it is not designed to be an in-depth look, but more of an overview.

The Federal Reserve

The Federal Reserve (or the “The Fed” as it is commonly referred to) was created by an Act of Congress with the explicit goals of “fostering maximum employment and price stability.” For current policy and an economic activity summary see the press release from the March 18thFOMC meeting (http://www.federalreserve.gov/newsevents/press/monetary/20150318a.htm). To keep this simple, the Fed raises rates when inflation is rearing its ugly head, or lowers rates when the economy is not doing well. These goals can be in direct conflict or there may be an exogenous event that may cause inflation to go up and the economy to stall. Or, there may be a credit crisis.

The Fed imposes reserve requirements on banks, which is a tiny percentage of banks’ deposits. Banks maintain these reserves over a short time period such as one or two weeks. If banks have excess reserves or require reserves, they lend/borrow to one another in the overnight Federal Funds market, simply referred to as overnight Fed Funds. The Fed influences this overnight rate in three different ways:

- Reserve Requirements—By increasing/decreasing the amount required to be held, the Fed influences the level of balances held at the Fed.

- The Discount Window—This facility gives banks the ability to borrow directly from the Fed at a rate known as the discount rate.

- Open Market Operations—This is the primary tool that The Fed uses to influence the Fed Funds rate. When conducting open market operations, the Fed can influence the amount of reserves in the banking system permanently by buying/selling government securities outright or temporarily through repurchase agreements, commonly referred to as repos. When buying securities, it adds money to the system and, when selling securities, it drains the system. Repos add, and reverse repos drain, the system.

The reserves or liabilities were free in that, traditionally, the Fed did not pay interest on them. In turn, the Fed purchased government securities thereby creating assets and rounding off their balance sheet.

For years, the Fed was able to target an overnight Fed Funds rate and maintain it using the above methodology.

Along comes the credit crisis . . .

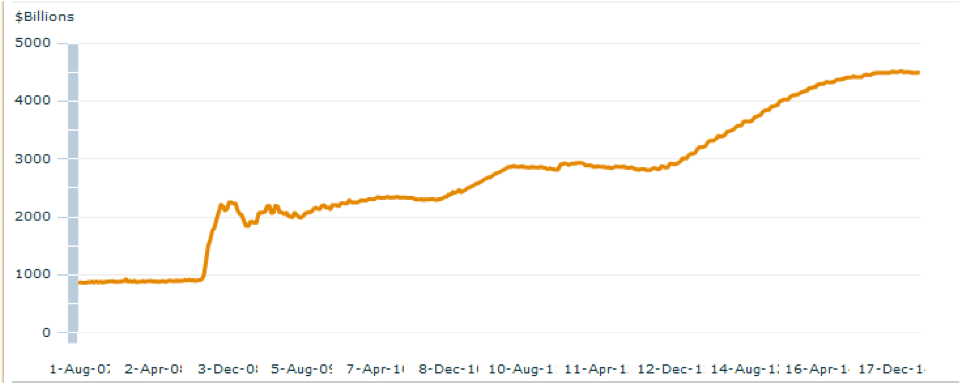

At the onset of the credit crisis the Fed engineered quite a number of unique programs to get money into the hands of institutions that needed it1. They also embarked on quantitative easing, or what is now known as QE. The Fed’s balance sheet went from approximately 800–900 billion in 2008 to over 4 trillion dollars (that is a lot of zeros!!) today, which is illustrated in the graph below:

To help them achieve and manage their target, currently in a range of 0.00%–0.25%, the Fed altered their policy in 2008 and started paying interest on reserves, both required and excess reserves. Therefore, when the Fed deems that rates should be higher, they will simply increase the rate they pay on reserves. The markets seem to be more focused on interest on excess reserves, or IOER.

In addition, the Fed will also use overnight reverse repos, or ON RRP, to manage their target. What is interesting here is that they have made this available to institutions outside the traditional primary government dealer community, including non-financial institutions. They have been testing this ON RRP since September 2013.

Whether the Fed raises rates this year or at some later date, one can count on them using these newer tools to manage interest rates and hence monetary policy.

References

1For those interested in the Feds response go to: http://www.federalreserve.gov/monetarypolicy/bst_crisisresponse.htm

About the author

Copyright © 2015 by Global Financial Markets Institute, Inc.

Download article