Overview

Municipal securities are an important part of the fixed-income market. While small at $4.2 trillion compared with the U.S. bond market at $52.9 trillion, municipal bonds are a critical financing vehicle for cities, towns, and states. The lion’s share of the municipal financings is for large, long-lived assets such as roads, bridges, hospitals, and schools.

Interest income that is received on municipal bonds is federally tax-exempt and, in some cases, state and local tax-exempt. This feature has a double benefit:

- As interest is tax-exempt, municipal issuers can issue bonds with lower interest rates than comparable corporate issuers.

- Investors in a high tax bracket receive interest income that is tax free.

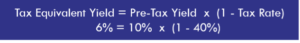

The calculation for an after-tax yield, also known as tax equivalent yield, is as follows:

Municipals are considered a conservative investment and generally have low credit risk. As they are backed by state or local taxes, or from revenues generated by local facilities such as bridges or tunnels, they tend to have reliable, consistent cash flows to pay both principal and interest. As such, municipals have historically had lower default rates than similarly rated corporate bonds.

As the Federal Reserve continues to raise interest rates and the threat of recession looms large, credit analysis will be all the more important when looking at municipal bonds. Higher interest rates will put additional cash flow pressure on municipalities. Investors should look at how well an issuer manages tax and revenue collection during all phases of the economic cycle.

Historical Municipal and Treasury Yield Movements

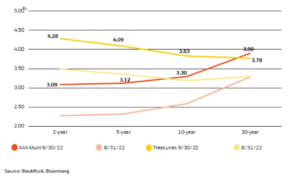

According to the Bond Buyer, “September municipal bond issuance declined 43% year-over-year, with nearly every structure and sector seeing large drops, as issuers eschewed the market amid another Federal Reserve rate hike and severe global market volatility.”1 Municipal bonds sold off in sympathy with Treasuries and, as a consequence, yields increased to the highest level of the year.

With the AAA rated Muni yields crossing above the comparable Treasury yield, there are compelling reasons to invest in highly rated municipals. Remember, most interest received from municipal bonds is federally (and sometimes state and locally) tax-exempt, while interest paid on Treasuries is taxable. For an investor in a high tax bracket, municipals are starting to look very attractive. For example if you are in a 30% tax bracket and invested in a 30-year AAA rated municipal at 3.90%, you would need an taxable equivalent yield of 5.57% (0.0390/(1-0.30) = 0.557 or 5.57%). Based on the chart above, we see that 30-year Treasuries, as of September 30, are yielding 3.78%, well below the taxable equivalent yield of 5.57%. Thus, it is clear that investors (in a 30% tax bracket) are in a more advantageous position when purchasing municipal bonds.

Is a Recession Forthcoming?

Also interesting to note, is that the above chart shows the Treasury yield curve is inverted – longer maturities are less than shorter maturities – another telltale sign of an impending recession. Notice that the municipal yield curve is not inverted, nor has it ever been. Why? As for the municipal market, the short end is perennially “rich” – that is, high in price and thus low in terms of yield. That reflects the persistent supply-demand mismatch with the lion’s share of issuance coming at the long end of the municipal market. As a result, short-term municipals only are worthwhile to those in the highest tax brackets, while farther out the yield curve the tax-exempt status pays off for those in lower brackets.

With the real threat of a recession in 2023, credit analysis of municipals will once again be very important as the market changes. One must look at the macro factors that affect the municipal issuer including demographics, wage growth, and unemployment trends.

GOs and Revenue Bonds

Let’s review the two largest types of municipal bonds – GOs and Revenue Bonds.

Local General Obligation (“GOs”) bonds are backed primarily by property taxes. Property taxes are based on the current assessed value of the home (except in California with Proposition 13). As mortgage rates increase, the value of the home may decrease – potentially lowering the property tax base of the municipality.

Revenue Bonds are backed by a specific revenue source – such as revenues from a specific project or a dedicated stream of sales taxes. For example, many shopping malls have issued revenue bonds. How will they do if the retail sector falters due to inflationary pressures and the risk of recession? Revenue bonds also can include hospitals, airports, toll roads and bridges, housing projects, convention centers, and similar endeavors. As their risk exposure is higher than GOs, they compensate by tending to pay out a higher yield to reward the investor. The big question is, how will these various specific projects fare during a potential recession or faltering economy?

Summary

There are some issues to consider which could threaten municipal bonds as an investment. Municipalities will have less reliance on Federal support now that Covid funding is going away. This country’s infrastructure is in severe need of repair or replacement. There is more and more resistance to an increase in taxes, both at the local and state levels. With rates at near zero for many years, the current rising rate environment is going to require more due diligence – not only in the municipal market, but the corporate market as well.

References

1 Bond Buyer – September 30, 2022

About the Author: Julie Barnum

With an extensive professional career in the credit markets, and many years in the financial instruction field, Julie Barnum brings a unique blend of knowledge and know-how to our clients. Currently, Julie is President of her own consulting firm for large multinational corporations, government regulators and financial institutions. Her assignments cover the globe: China, Europe, Russia, Australia, and the United States.

Julie is also a Director and Chief Credit Officer of Yavapai Regional Capital, a regional infrastructure merchant bank which specializes in advisory and management work for public private partnerships in the southwestern United States.

Prior to starting her own consulting business, Julie was with Pearson plc for four years, as the Global Director of Credit for the FT Knowledge/NY Institute of Finance training arm. Here, she headed up all Credit and Corporate Finance related learning programs – creating and delivering custom curriculums. Her case study materials were used for Valuations, Capital Structuring, Projections, Strategy, and Covenant Setting. Later, as the Managing Director for NYIF, her responsibilities included the public course schedule and oversight of Accounting, CFA Exam Prep, Credit Risk, Corporate Finance, Fixed Income, Portfolio Analysis, Technical Analysis and Wealth Management courses.

Prior to Pearson, Julie worked for over 15 years with various divisions of Paribas in Los Angeles, Paris, and New York. For example, she served as a Senior Credit Officer in the Risk Management Division, where she approved all new and existing media, telecom, and entertainment related loans in North and South America, with structures ranging from negative cash-flow loans with equity kickers to large syndicated credits. She approved all corporate loans in the Southwest region with emphasis on leveraged transactions in corporate roll-ups, waste management, and leveraged aircraft finance. As the Head of International Training for the Corporate Banking Division, Julie designed, implemented, and managed Credit Training, covering 60 countries and 2,000 employees, conducted global needs analysis, leading to creation of Paribas’ first in-house worldwide Credit Training Program, and delivered one-week entry level credit programs in China and the Mid-East.

Copyright © 2022 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

Download article

My Cart

My Cart