The Evolution of Student Loans

The new administration and the hyperbole around socialism has led many pundits to discuss the student loans that are on the U.S. Government’s balance sheet. There are currently over $1.5 trillion of student loans outstanding. These loans can be categorized as either government backed/originated or private student loans. This article looks at the history of student loans and where we are today.

History of Student Loans

In 1965, the U.S. government established the Higher Education Act of 1965, more formally known as the Federal Family Education Loan Program or FFELP. These loans were guaranteed by the Federal government. Although there were two other programs, FFELP was the dominant program.

Any loan needs to be originated and serviced. Student loans are no different. The FFELP program used intermediaries such as Chase Manhattan Bank, among others, and Sallie Mae (SLMA: Student Loan Marketing Association) for origination and servicing.

Who is Sallie Mae?

Sallie Mae was similar to Fannie Mae and Freddie Mac in that it was originally a government sponsored enterprise (GSE). Sallie Mae purchased student loans from originators and held the loans on their balance sheet. Since they were a GSE, they were able to borrow funds at a lower cost than other financial intermediaries. However, in 1996 Congress passed an act privatizing Sallie Mae and by December 2004, they were fully privatized.

As an interesting side bar, the privatization of Sallie Mae may be compared to the current situation with Fannie and Freddie. Specifically, the Great Financial Crisis highlighted the extensive risk that GSEs create for taxpayers. A report from the U.S. Department of Treasury titled Lessons Learned from the Privatization of Sallie Mae (https://www.treasury.gov/about/organizational-structure/offices/Documents/SallieMaePrivatizationReport.pdf) referred to Sallie Mae’s debt: “Eliminating this debt also eliminated the perceived risk to taxpayers that the Federal government might step in and bail out the GSE if it failed.” To date, Fannie and Freddie remain GSEs and are in conservatorship at this writing.

Back to student loans! Private student loans are originated by financial institutions and are not government backed. They were mainly used to finance higher education. The analogy might be jumbo or non-conforming loans in the mortgage market compared to conforming mortgage loans or, in this case, federally backed student loans.

Student Loans Today

Government Loans

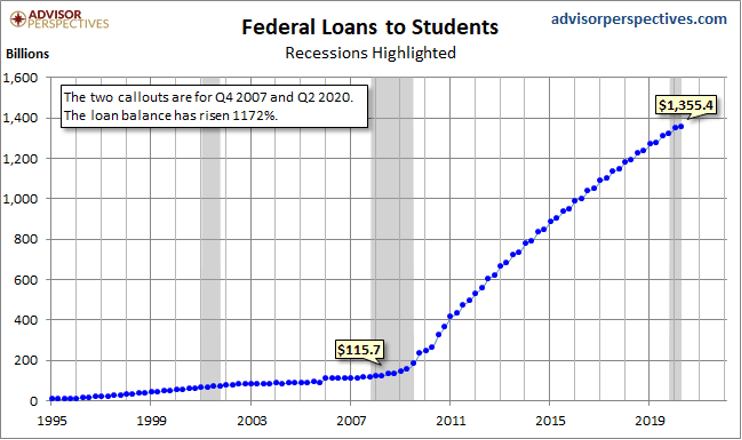

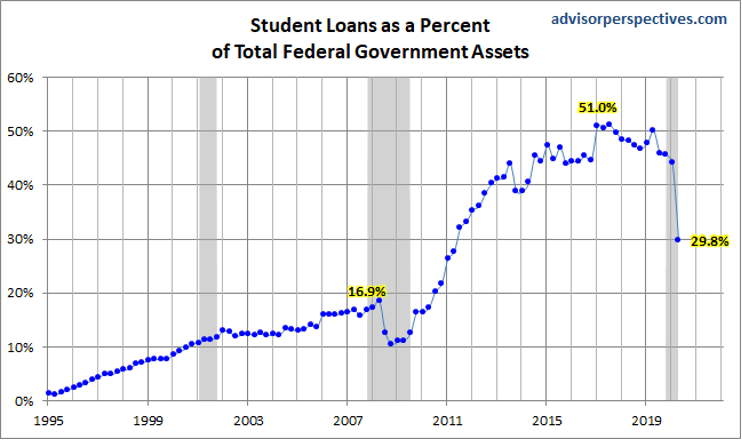

FFELP no longer exists today but student loans are available through the U.S. Department of Education. The Education Reconciliation Act of 2010 removed private lenders from the federal student loan program. However, lenders still had large portions of FFELP loans given their long maturity date and ultimate payoff. The following two graphs, as of Q2 2020, give a good indication of federal student loan growth and their percentage of U.S. federal government’s assets:

As seen in the first chart, the growth of the loan balance from 2007 to 2020 is nothing less than astronomical. It doesn’t take a mathematician to figure out that with $1.5 trillion dollars of student debt outstanding, students loans held by the government completely dominates this sector. The question on everyone’s mind is, will the government absorb these student loans? Let’s first look at the private market, mention securitization’s role and then take a look at delinquencies and defaults.

Private Student Loans

Financial intermediaries such as Wells Fargo and Discover originate student loans. Others, such as JPMorgan Chase, have pulled back from this market. These loans are similar to any other consumer loan and are based on the creditworthiness of the borrower. If the borrower declares bankruptcy, they are still required to pay back the student loan. Many student loan borrowers have cosigners.

A new area in this market are refinance loans or simply refi loans. Given the advent of Fintech1, new entrants such as SOFI (Social Finance)2 have sprouted up as lenders in this marketplace. These refi loans help borrowers consolidate or more specifically refinance their student debt and hopefully lower their interest expense.

Securitization3

Securitization has played a role in the student loan market going back to the Sallie Mae days. Many of the private loans are securitized and removed from the originators’ balance sheets. (In fact, there are still enough FFELP loans outstanding that create securitizations/Asset Backed Securities). This is not the case for the loans on the Federal Government’s Balance Sheet, as these still remain on it.

Student Debt Outstanding

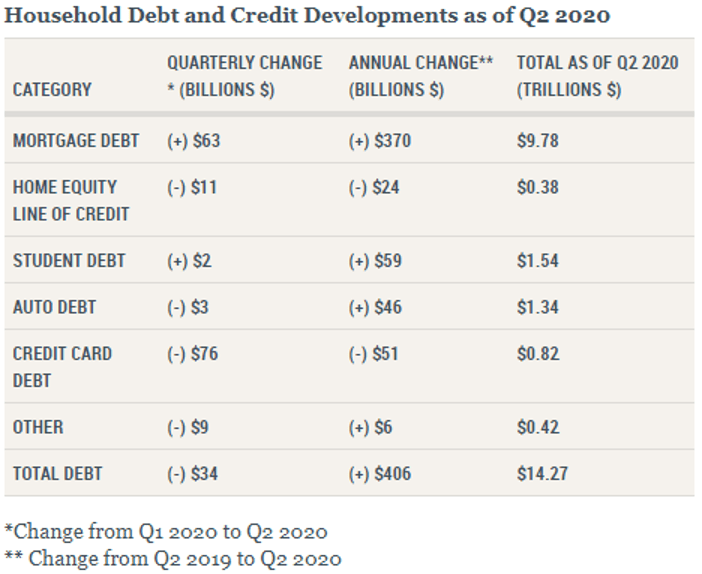

According to Liberty Economics, student debt makes up approximately 10.7% of household debt.

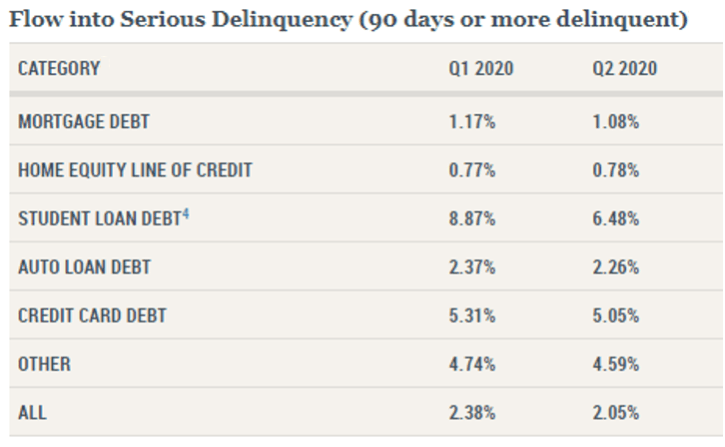

Liberty Economics further indicates the level of delinquencies:

Generally, this is not a pretty picture, for when a loan goes into 90 days of delinquency, there is a very high probability it will end up in default.

According to the latest data from Quarterly Report on Household Debt and Credit 2020:Q4, released in February 2021 (https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2020Q4.pdf) from the Federal Reserve Bank of New York, Research and Statistics:

“About 6.5% of aggregate student debt was 90+ days delinquent or in default in 2020 Q4. (The above chart is Q2 2020). The lower level of student debt delinquency reflects a Department of Education decision to report current status on loans eligible for CARES Act forbearances.”

Conclusion

Clearly the government role in student debt is immense. Just as clear, many borrowers are on a road to default. One question that comes to mind is a very controversial issue – do we want so many borrowers in default at presumably such a young age? The Biden plan, although not official law yet, will potentially forgive some level of debt from $10,000 to $50,000. This may be good for the individual but brings out some challenging questions:

- What about private student loans? Should they not be included in the plan?

- Is this student debt hindering other parts of the economy as the borrower may not be able to increase their debt load?

- Should this bill get passed, would it compromise U.S.’s ability for future borrowing in the capital markets considering the significant increase in our outstanding debt due to the pandemic?

- Will interest rates continue to remain low affording the U.S. continued low interest expenses? Or will inflation rear its ugly head? On that note, the U.S. Treasury curve is beginning to widen as the 10 and 30-year U.S. Treasuries move higher as the Fed keeps short-term interest rates low.

- If the Biden law is passed, will it not play into the hands of the crowd claiming the U.S. is becoming a “socialist” country?

This is truly a challenging situation that doesn’t appear to be going away any time soon.

References

1 For more on Fin Tech go to https://www.gfmi.com/articles/practical-fintech-for-financial-professionals/

2 For more on SOFI go to https://www.sofi.com/our-story/

3 For more on Securitization go to https://www.gfmi.com/securitization-and-credit-ratings-revisited/ and https://www.gfmi.com/articles/collateralized-loan-obligations/

Resources

An Education in Student Loans ABS: Lehman Fixed Income Research; U.S. Securitized Products, May 22, 2008

A Basic Education in Refi SLABS Barclays U.S. Structured Credit, October 14, 2016

About the Author: Kenneth Kapner

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management. He has been a Risk Management Advisor to a Mutual Fund’s Board of Trustees and has served as an Expert Witness using knowledge of derivatives, trading and risk management.

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Publications and Articles

Articles

2019 3-Month SOFR Futures

2019 LIBOR Schmibor: What’s Next? SOFR Part I and Part II

2018 VIX, Volatilities, and Exchange Traded Products

2018 Settlement Risk and Blockchain

2017 Electronic Trading and Flash Crashes – Part I and Part II

2016 The Long and Short of IT: An Overview of XVA

2016 The Long and Short of IT: An Overview STACR and CAS

2016 The Federal Reserve Tolls: Past and Present

2016 The Perfect Storm: October 2008

2016 Interest Rate Swap Futures: An Introduction

2014 Risk Reversals

2002 Futures Magazine, Doing Your Homework on Individual Equity Futures (Co-written with Robert McDonough)

Blog

Ken also edits and writes for the GFMI Blog.

Books

1996 Como Entender Los Swaps, (co-author: John Marshall), published by CECSA (a Mexican publishing firm). This is a translated edition of our book Understanding Swaps, but with adaptations to fit the Mexican markets. (289 pages)

1993 The Swaps Market: 2nd edition, Kolb Publishing, 288 pages (co-author: John Marshall, copyright 1993). This book is directed to the graduate business student.

1993 Understanding Swaps, John Wiley & Sons, 270 pages (co-author John Marshall, copyright 1993). This book is directed to the practitioner market and is published as part of Wiley’s Finance Series.

1993 1993-94 Supplement to the Swaps Handbook, New York Institute of Finance, a Simon & Schuster Company, 494 pages, (co-authors John Marshall and Ellen Lonergan, copyright 1993). This book is directed to a practitioner audience and is a supplement to The Swaps Handbook. My role was largely that of editor.

1991 1991-92 Supplement to The Swaps Handbook, New York Institute of Finance (Simon & Schuster Professional Information Group), 300+ pages (co-author: John Marshall copyright 1992). This book is directed to a professional practitioner audience and is an annual supplement to The Swaps Handbook.

1990 The Swaps Handbook: Swaps and Related Risk Management Instruments, New York: New York Institute of Finance, a Simon & Schuster Company, 543 pages. (co-author: John Marshall). This book is directed to derivative product professionals.

1988 Understanding Swap Finance, Cincinnati: South Western publishing Company, 155 pages. (co-author John Marshall, copyright 1990). This was the first academic text published on the swaps markets.

Affiliations

International Association of Financial Engineers Board of Advisors – 1994 – 2010

Global Association of Risk Professionals

ATD National and New York Chapters

Copyright © 2021 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

My Cart

My Cart