What were the Reasons for the Subprime/Credit Crunch in 2008?

There have been a plethora of reasons given by the media for what created the subprime/credit crunch crises. However, in speaking with people within the industry, as well as friends and family, it appears not everyone understands the various reasons culminating in the credit crunch of 2008.

No one reason, but the right blend of ingredients coming together simultaneously created the perfect storm. This article does not purport to explain all the details, but rather to summarize the different reasons—as reported by the media and those that were not—and how each reason was a cog in the “perfect storm” wheel.

It is important to note that the article attempts to cite and reference the reasons presented by the media and does not necessarily indicate agreement or disagreement with them.

Background: Mortgages

Mortgages are broken down into three categories: Prime1, Alt-A, and Subprime. Prime borrowers have a good credit history, provide a down payment on their home and can fully document their income. Alternative A borrowers (“Alt-A”) are just a drop below prime. For a variety of reasons, they may not be able to document their income (someone leaving a secure job and starting a new business or not having enough money for a down payment but with a good credit history). Subprime is below Alt-A and is characterized by a poor credit history, uncertain income and no down payment. These types of loans, by their very nature, will have higher defaults and therefore, demand higher borrowing rates.

FitchRatings estimates $1.4 trillion of subprime mortgages were originated from 2005–2007.2 The heart of the subprime meltdown rested with the default of these loans.

Community Reinvestment Act (CRA)

This act was created in 1977 during the Carter presidency. According to the Federal Reserve website: “The Community Reinvestment Act is intended to encourage depository institutions to help meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods, consistent with safe and sound operations.”3When I personally served on the Asset Liability Committee (ALCO) at HSBC in the early 1990’s, we discussed what loans we were creating to meet CRA requirements. No one questioned why the loans were being originated; it was taken for granted that the bank must meet the requirements. Although not part of CRA, the Federal Housing Enterprises Financial Safety and Soundness Act of 1992was passed requiring Fannie and Freddie to purchase mortgages in the secondary market that met the requirement of affordable housing, i.e., subprime mortgages. The government required banks to make subprime loans and also required government agencies to purchase these mortgages in the secondary market.

In 1995, additional CRA regulatory changes were implemented cutting back due diligence paperwork to expedite loan applications. Between 1993 and 1995, $467 billion additional CRA lending took place to low-medium income applicants in inner city/rural areas.4In 2003, a report by the Federal Reserve stated “Today less than 30 percent of all home purchase loans are subject to intensive review under CRA. In some metropolitan areas this share is less than 10 percent.”5

Easy money at the Fed

Alan Greenspan was often blamed for the credit crisis in that during his tenure, the Federal Reserve loosened monetary policy, keeping interest rates very low. In addition, risk premiums, given as a spread to Treasuries, narrowed considerably. Investors were looking for ways to increase their returns and turned to the securitization markets.

Lower credit standards at the individual loan level

During the Greenspan time period of easy money, many lending organizations lowered their credit standards in evaluating individual borrowers. This lack of due diligence added more fuel to the growing credit problem.

New types of mortgages

Creative lenders devised new types of loans. Although adjustable rate mortgages (“ARMs”) had been around for years, Hybrid ARMS became a part of the mortgage landscape. A traditional ARM uses a benchmark rate, such as a U.S. Treasury Bill or LIBOR, adding a margin/spread over this benchmark. The spread may be in the 2–3% range. The initial low “teaser” rate induced the borrower into entering into the agreement. The loan would reset after a set period such as one-year. There may be an annual cap, a lifetime (of the loan) cap and possibly a lifetime floor.

A Hybrid ARM combines the fixed rate portion of a fixed rate mortgage (“FRM”) with the adjustable rate of the traditional ARM. For example, a 5/1 loan would adjust annually for the next five years and then lock-in a fixed rate for 25 years. Some structures were created as interest only. Such a loan may be structured to charge the borrower interest only for 5 years and then reset to a fixed rate for the remaining 25 years. When the loan “resets” at the fixed rate, the lender used a 25-year amortization schedule making the monthly payments higher than what they would have been on a traditional 30-year mortgage.

There are many varieties of these loans6which became more and more prevalent in the subprime market. More importantly, many people were unable to afford the mortgage when it reset into a fixed rate. Lenders did not do their due diligence on the borrower’s ability to afford higher monthly payments and market sentiment was that real estate values would perpetually increase. Therefore, if the borrower could not afford the payment after the reset, they simply could sell the house. The assumption of home price appreciation indicated that the home would have some equity in it.

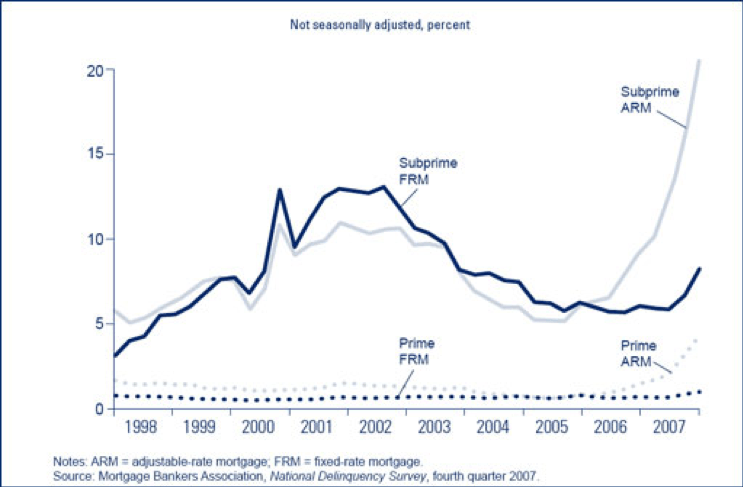

Chart 1 shows percentage of delinquent mortgage payments broken down by subprime ARM and subprime FRM and Prime ARM and FRM.

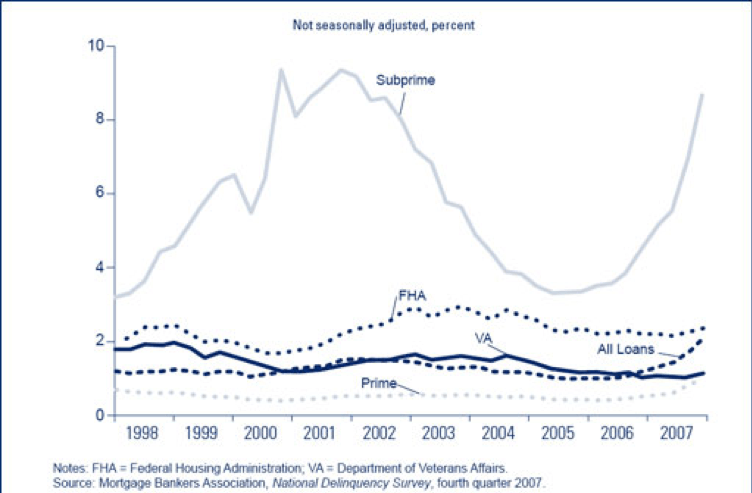

Chart 2 shows the level of foreclosure in subprime ARMs at the end of 2007.7

Chart 1: Seriously Delinquent Subprime ARMs Soar to Record High

Chart 2: The Rate of Subprime ARMs in Foreclosure Almost Doubled from the Prior Year

Fraud

Misrepresentation by prospective borrowers on their mortgage applications in order to get new loans gave birth to a new term in the market: “Liar loans”.

Unusual Loans

NINJA loans (“No Income No Job [and no] Assets”) were submitted and approved. Another variation was “125 loans” or loans that were made for 125% of the value of the home. It is hard to understand why a lender would structure a loan that is 125% of the value of the home, except to speculate that the housing value bubble would continue to grow.

Securitization

Securitization is the process of taking assets, such as subprime loans, and bundling them together to create a new “pooled” security. Such an investment security is the residential mortgage backed security (RMBS) that is “backed” or collateralized by individual subprime loans. This investment is sold to investors who expect to receive their interest and principal repayment from the pooled securities backing this vehicle, i.e., subprime loans.8Other similar vehicles are Asset Backed Securities (“ABS”). One particular type of ABS is called a collateralized debt obligation (“CDO”). The assets used in the CDO can be bonds, loans or subprime RMBS! (When ABS are used as the collateral in a CDO it is formally called an ABS CDO.) Briefly, the steps required in a subprime securitization are:

- Financial institutions originate subprime loans.

- Since the loans are small, they need to be bundled together to increase their size to make them attractive to institutional investors, e.g., pension funds, mutual funds, etc. The bundled package of smaller loans is sold to these investors in the form of notes known as RMBS.

- These notes can be a single note or can be carved up into classes—commonly called “tranches.” Each tranche receives a different credit rating from a credit rating agency. This allows investors to choose the asset that best suits their individual needs. The higher the credit rating (credit ratings are explained below) the lower the yield, and the lower the credit rating, the higher the yield. In general, investors receive higher rates of return because the subprime securities backing the notes pay a higher rate of interest which is passed along to the investor. Recall that the low interest rate environment of “easy money” and narrowed risk premiums so investors were looking for increased yield opportunities.

- Many times the originating financial institutions were unable to sell all of these notes/tranches. In this case, they were retained on their balance sheet, a process referred to as warehousing. In normal times, the difference between financial institutions’ funding costs and the return on the asset was substantial. Once the meltdown began, financial institutions wound up holding on their balance sheets what is now known as toxic waste, i.e., subprime loans that are in default.

- The exposure to subprime was amplified by using credit default swaps (“CDS”). A CDS is a form of insurance that guarantees the performance of a specific bond or entity. The guarantee entails full redemption of principal upon default of the referenced bond. The reference bond creating all the havoc? You guessed it: RMBS backed by subprime loans. However, it is important to note that CDS were used in the creation of CDOs, and greatly increased the amount of leverage. Thus, the use of CDS resulted in the exposure being far greater than the $1.4 trillion in subprime loans that were originated from 2005–2007.

Financial institutions earned fees during the origination process and earned a positive spread on the assets kept on their books. Obviously these numbers were substantial.

Credit Rating Agencies

Why would investors purchase these securities? To understand the answer to this question a quick review of the main objectives of credit agencies is needed.

Traditionally, credit rating agencies assign a rating to bonds issued by corporations. This rating measures the probability that the borrowing corporation will repay their debt. The ratings are broken down into investment grade and non-investment grade (sometimes called “junk”). Investment grade is further categorized into letter ratings such as AAA, AA, A, BBB. (For further clarification, go to www.moodys.com, www.sandp.comand www.fitchratings.com.) Non-investment grade ratings start at BB and go through D indicating default. The higher the credit rating, the lower the initial coupon on the bond and vice versa. Most corporate bonds are nothing more than an IOU. Therefore, credit analysts at the rating agencies scour corporate financial statements analyzing whether they will have the cash flow to pay the interest and redeem the principal upon maturity of the bond. Most investors’ decision making rely heavily on credit ratings.

The assets backing the notes in CDOs ranged from subprime loans to corporate bonds/loans, to prime residential mortgage backed securities (RMBS) and may have included derivatives, such as credit default swaps on subprime RMBS. Credit analysts had to assign ratings not on a corporation’s financial condition but on a myriad of securities which were collateralized by individuals with bad credit—all the way to credit default swaps which were included in some of these CDOs. The valuation procedure required using models which replicate real world scenarios given a variety of assumptions. When tranches that were rated AAA began plummeting in value, it became clear that the “real world” models did not account for the subprime markets’ higher default rates that were occurring.

Lack of Due Diligence at the Investor Level

Investors had grown complacent because of the direct correlation to corporate ratings and their traditional accuracy in determining default probability. Investors simply took it on good faith that credit ratings would stand up when applied to ABS CDOs and RMBS backed by subprime loans. This proved to be a dangerous assumption. Many investors blindly followed, without independent analysis, the ratings assigned to these tranches without examining the underlying securities. Summed up nicely by Andrew Davidson: “That is the problem with the current secondary market, especially for subprime loans: no one is the gate keeper, shutting the door on uneconomic loans. Rather than conducting his/her own analysis, the ultimate CDO investor, to a large extent, placed trust in the first loss investor, the rating agencies and the CDO manager. In each case that trust was misplaced.”9

Greed

During the process from loan origination and loan securitization, to the subsequent selling to investors, people got fat! Mortgage brokers got fees; financial institutions made billions and executives received sizeable bonuses along the way. Earnings at credit rating agencies were soaring predominantly due to rating ABS. Everyone was profiting and—as we know—during the good times, no one asks the “right questions” or takes the appropriate actions.

Risk Management

When defining the objective for risk management, The Federal Reserve is quoted as follows: “The primary goal of risk management is to ensure that a financial institution’s trading, position-taking, credit extension, and operational activities do not expose it to losses that could threaten the viability of the firm. Global risk management is ultimately the responsibility of senior management and the board of directors…”.10

Financial institutions develop a risk management process to identify, measure, manage, report and control market and counterparty risk. Needless to say this process broke down in the following ways:

- Subprime concentration risk in loan warehousing

- Difficulty determining prices through modeling

- The amount of assumed risk compared to capital was extensive

- The reporting of the amount of risk and action (or inaction) taken by senior management

- Lack of foresight by senior management to not identify the credit crises turning into a liquidity crises

Regulation

There are many regulators overseeing financial institutions’ capital market activities: the SEC, Federal Reserve, FDIC, OCC, FHFB, OTS and NCUA to name a few! The one agency which took the brunt of abuse from the press was the SEC, specifically in their risk management oversight responsibilities for investment banks. These regulatory bodies completed an exam and reported their findings. According to the inspector general report the SEC failed in this responsibility.11

External and Internal Auditors

One aspect we haven’t heard too much about is the external and internal auditors. Where were they during this process?

Mark to Market Accounting

Mark-to-market (MTM) or “fair value accounting” refers to the process of valuing a security at current market prices.To help understand this process, assume a security was purchased for $1.00 and is now worth $.20. The financial institution has to record the $.80 loss. This doesn’t seem too damaging until we look at larger numbers, i.e., the amount of the security purchased is worth $1,000,000,000, in which case, the write-off is $800,000,000! When comparing traditional accrual accounting to MTM, the damage is a lot less pronounced.

Using the same example under accrual accounting, if we assume a 5-year asset that yields 10% and the cost of funds are 9%, the financial institution would book $100 million of interest income, $90 million of interest expense and $10 million of annual net income for 5-years without incurring any principal loss! Thus, using accrual accounting the financial institution would be able to show the world a profit while using MTM accounting, the financial institution shows a substantial loss.

“Financial Accounting Standards Board (FASB) has been the designated organization in the private sector for establishing standards of financial accounting and reporting”.12(FASB oversees accounting standards in the U.S. whereas the International Accounting Standards Board, IASB, oversees accounting standards at an international level.) Statements of Financial Accounting Standards (SFAS) are issued by FASB. Recently FASB issued SFAS 157, which sets the standards for MTM. The timing could not have been worse given the illiquidity and volatility of the market.

Summary

Clearly there were many reasons for the subprime debacle. All the right pieces fell into place at the right time. And as any trader will tell you, timing is everything in the market!

References

1There is a fourth category known as jumbo. These loans are defined as being greater than the maximum conforming loan size as defined by the Office of Federal Housing Oversight (OFHEO). This amount changes annually, most recently the limit was $417,000. Any loan greater than this amount is not eligible for purchase or guarantee by Fannie and Freddie.

2http://fitchratings.com/corporate/reports/report_frame.cfm?rpt_id=386342

3http://www.federalreserve.gov/dcca/cra/

4The Community Reinvestment Act After Financial Modernization. United States Department of Treasury (April 2000, page 15). www.treas.gov/press/releases/reports/crareport.pdf

5Apgar, William C.; Mark Duda (June 2003). “The Twenty-Fifth Anniversary of the Community Reinvestment Act: Past Accomplishments and Future Regulatory Challenges”. FRBNY Economic Policy Review (June 2003). Federal Reserve Bank of New York. http://www.newyorkfed.org/research/epr/03v09n2/0306apga.pdf

6For more information on ARMS and Hybrid ARMS, visit Freddie Mac’s website at: http://www.freddiemac.com/corporate/buyown/english/mortgages/what_is/adjustable_rate.html

7 http://www.fdic.gov/regulations/examinations/supervisory/insights/sisum08/article01_Hybrid.html

8For more information on securitization, see Global Financial Markets Institutes’ October 2006 Newsletter. The article is titled Introduction to Collateralized Debt Obligations. http://gfmi.com/newsletters.0610.html

9http://www.ad-co.com/newsletter/issues2007/SixDegreesofSeparation.htm

10http://www.federalreserve.gov/boarddocs/supmanual/default.htm#trading

11http://www.sec.gov/about/oig/audit/2008/446-a.pdf

About the author

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998.

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998.

Copyright © 2014 by Global Financial Markets Institute, Inc.

Download article My Cart

My Cart