Introduction to STACR and CAS

Fannie Mae and Freddie Mac now have issued numerous credit risk transfer notes in this ever evolving market. This article summarizes some of the highlights of the issues/securities called Structured Agency Credit Risk or STACR, which are issued by Freddie Mac, and Connecticut Avenue Securities or CAS, which are issued by Fannie Mae.

Origin of STACR and CAS

The notes are part of a Dodd-Frank Act mandate to reduce the credit risk undertaken by Fannie Mae and Freddie Mac in the residential mortgage lending markets and to protect taxpayers from potential loss. The notes can also be viewed as part of the agencies’ overall funding strategy. The notes are unsecured IOU’s on which Fannie and Freddie are legally obligated to pay principal and interest. However, credit losses, and therefore eventual repayment, are based on a specific reference pool of mortgages that the agencies have purchased and are holding on their balance sheets. Since the notes derive their value from the cash flows associated with a reference pool of credit-risky assets, they are considered to be credit-linked notes (CLNs).

Investors in the notes share any credit losses with Fannie and Freddie. Alternatively, the agencies are able to purchase partial or full credit insurance on these notes from private insurance companies through a separate program. These transactions are known as Fannie Mae Credit Insurance Risk Transfer (CIRT) and Freddie Mac Agency Credit Insurance Structure (ACIS). Regardless of the type of transaction, this “risk sharing” is different from traditional pass-through mortgage-backed securities (MBS), whereby the investor is looking to the underlying collateral to pay principal and interest and also has an outright guarantee from Fannie and Freddie. For example, the STACRs 2016-DNA1 reference pool has the following characteristics1:

- Original total collateral: $535,724,056,399

- Original loan count: 144,144 prime, first lien mortgages

- Weighted average current LTV of 75%

- Weighted Average FICO score: 754

The structures include sequential-pay tranches and a senior/subordinated credit enhancement with the following features:

| STACRs | CAS | |

| Debt | Unsecured and not guaranteed by Freddie Mac or U.S. government | Unsecured and not guaranteed by Fannie Mae or U.S. government |

| Coupon | 1M LIBOR plus a spread | 1M LIBOR plus a spread |

| LTV | Two types of issues:

60 – 80% Greater than 80% but less than 100% |

The latest version is one issue but 2 underlying collateral groups:

Group 1: 60 – 80% Group 2: Greater than 80% but less than 100% |

| Maturity | 12-½ years, but earlier deals 10 years |

10 years |

| Losses | Actual losses (this is the convention going forward) although earlier deals were fixed severities | Actual losses (this is the convention going forward) although earlier deals were fixed severities |

| Risk Retention – Subordinate Debt | 5% vertical slice | 5% vertical slice |

| Risk Retention -Equity/First Loss Piece | Minimum 50% retained | 100% retained |

Illustration of STACR and CAS

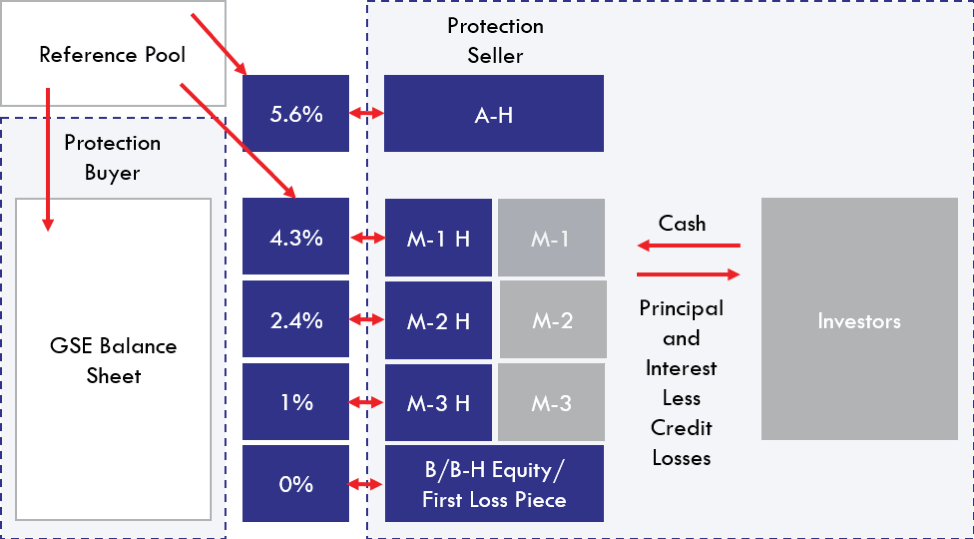

Figure 1 below illustrates the structure. The “A” tranche is retained by Fannie and Freddie. Investors can participate in tranches M1 through M3 (Fannie usually only issues two mezzanine tranches and Freddie, three) and the “B” tranche/first loss piece (Freddie may sell off 50% of this tranche but is always required to maintain 50% of this tranche). The tranches that are followed by the letter “H” are retained by Fannie and Freddie.

Figure 1: Generic STACR/CAS Structure

The vertical slice is kept by Fannie/Freddie to keep their interests aligned with those of the investors. Vertical slices require the retention of a portion of each slice in the capital structure of the notes. The percentages next to the tranches (these are for illustration purposes only) indicate the subordination levels. For example, the B tranches would absorb the first losses incurred by the referenced pool. If the losses were greater than 1%, then Tranches M-3 and M-3H would begin to absorb losses. If the pool losses were 2.4% or greater, then Tranches M2 and M-2H would absorb the losses. If the pool losses are 4.3% or greater, then tranches M1 and M-1H would absorb the losses. Fannie and Freddie retain tranche A-H which requires them to absorb all the remaining losses.

Two other terms referenced in the picture are “protection buyer” and “protection seller.” These terms are borrowed from the credit default swap (CDS) market. The protection buyer is purchasing protection against losing principal and/or interest. In this case, Fannie and Freddie are the protection buyers. The investor is taking on the credit risk and is said to be the protection seller. The structure itself does not contain a CDS but it is, in effect, achieving the same result by transferring the credit risk from the agencies to the investors.

STACR and CAS Due Diligence

Potential investors should conduct the same type of pre-purchase due diligence on these notes as they would for an asset-backed structure. They should analyze prepayments, defaults, severities and of course delinquencies. But as the markets found out during the credit crisis, if proper due diligence on the underlying collateral backing these types of structures has not been performed, then the notes issued will have a high probability of incurring significant losses. Fannie Mae and Freddie Mac have taken great pains to explain their underwriting standards and quality control when purchasing the individual loans. They provide extensive data, such as historical defaults, as well as transparency in the underlying pools, so that investors may make informed investment decisions. Other references available to investors to evaluate the notes, include the offering circular/prospectus and pre-sale reports from the rating agencies, as most of the deals are rated.

References

- This information is referenced from the Moody’s Presale report dated January 7, 2016

About the Author: Ken Kapner

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

About the Author: Rob McDonough

Rob McDonough is currently the Senior Consulting Manager of Angel Oak Capital Advisors, LLC, a registered investment advisory firm serving the investment, risk management, and capital markets needs of financial institutions.

Rob McDonough is currently the Senior Consulting Manager of Angel Oak Capital Advisors, LLC, a registered investment advisory firm serving the investment, risk management, and capital markets needs of financial institutions.

He is responsible for evaluating and managing the risks of seven private hedge funds and one public mutual fund that are primarily invested in non-agency mortgage-backed securities (NARMBS) and commercial loan obligations (CLOs). He leads engagements which include market and credit risk model validations, funding and core deposit study analysis, strategic and regulatory DFAST stress testing implementations, and investment portfolio risk and performance assessments, as well as technical training and executive education. Earlier, Rob was Chief Risk Officer, where his responsibilities included developing risk monitoring systems to assess market, credit, and operational risks associated with multiple public and private investment funds. He was also responsible for managing the internal policy compliance and external SEC regulatory compliance processes.

Rob is also the President and CEO of a financial services consultancy specializing in risk management consulting and training for institutions managing market, credit, operational, and other risks. He is a consultant and instructor for the Investment Training and Consulting Institute, Inc. and a Certified Investments and Derivatives Auditor (CIDA). He is also an instructor for many other organizations and industry groups including GFMI.

Rob started his career with the Federal Reserve System, where for twelve years he was an economic analyst and a capital markets safety and soundness examiner. His primary focus was regulatory policy development as well as assessing the condition of large complex domestic and international financial institutions. He developed significant field work experience in conducting safety and soundness examinations for banks and holding companies domestically and internationally. Rob also chaired a Federal Reserve System-wide committee to design, develop and deliver training for selected capital markets examiners across the country. This training was also implemented in a number of foreign central banks.

After leaving the Federal Reserve System in 1998, Rob joined Accenture as a Senior Manager in the Financial Services Industry Group, where he headed a joint task force responsible for defining and implementing the post-merger organizational structure for First Union’s Brokerage Division’s IT department.

Rob is a charter holder of the Bank Administration Institute’s Certified Risk Professional (CRP) designation and the ITCI Certified Investments and Derivatives Auditor (CIDA). He is a CFA Level II candidate for 2016. Rob has delivered capital markets and risk management seminars to financial institutions across the US as well as in 28 countries throughout LATAM, Asia Pacific, and Europe.

Publications

Articles

“Smaller Banks Are Dodd-Frank Losers”; CFO.com, June 23, 2015

“Doing Your Homework on Individual Equity Futures”; Futures Magazine, March 2002 (with Ken Kapner)

“Brady Bonds in Latin American Capital Markets”; Capital Markets Update, FRB Atlanta, October 1997

“Valuing Interest Rate Swaps”; Capital Markets Update, FRB Atlanta, March 1996

“Structured Note Bifurcation”; Financial Update, FRB Atlanta, October 1992

Copyright © 2016 by Global Financial Markets Institute, Inc.

Download article My Cart

My Cart