Low interest rates equals strong currency?

The idea of borrowing on an uncovered basis in a low interest rate foreign currency has been around for many years. The Swiss franc in the 1980s, the Japanese yen in the 1990s and more recently, Hungarian consumers taking out mortgages denominated in euros. These are just three examples of what once seemed like a way of saving money that has turned out to be a financial disaster. Borrowers saved in interest cost, but when it came time to repay the principal, they incurred significant losses because the currencies they borrowed in had appreciated dramatically– yes even the euro, (well at least against the Hungarian forint!). The rate went from EUR/HUF 245 in 2006 to 305 in 2015, a fall in the value of the forint of 24%. So historically, low interest rates have been associated with strong currencies, and high interest rates have been associated with weak currencies.

This time it really is different!

This time it really is different! The euro, with a very few notable exceptions, cannot be regarded as a strong currency because of the Greek scenario– stagnating economic activity and the emergence of populist anti-EU rhetoric. Yet German government bond yields have been negative and are still very low! In Switzerland, government bond yields are still negative.

What does this mean for the Debt Capital Markets in Europe?

So, what does this mean for European Capital Markets? An opportunity to innovate! And that is what has happened in the first six months of 2015 with the emergence of the “Reverse Yankee” bond market.

What is a “Reverse Yankee”?

A “Reverse Yankee” is a bond issued by a US company, usually high grade, outside of the US and denominated in a currency other than US dollars.

Here are two examples, of many, to review . . .

| Coca Cola Senior Unsecured | Issued in February 2015 | Credit Rating AA |

| Amount | Maturity | Coupon |

| €2 billion | 2017 | FRN |

| €2 billion | 2019 | FRN |

| €1.5 billion | 2023 | 0.75% p.a. |

| €1.5 billion | 2027 | 1.125% p.a. (priced at 95 to yield 1.53% p.a.) |

| €1.5 billion | 2035 | 1.625% p.a. |

| Apple Inc. Senior Unsecured | Issued in February 2015 | Credit Rating AA+ |

| Amount | Maturity | Coupon |

| CHF 875 million | 2024 | 0.375% p.a. |

| CHF 375 million | 2030 | 0.75% p.a. |

What is striking about these two deals is the following:

- The coupons that the borrower paid are incredibly low by historical standards.

- Some of the maturities are over ten years.

- When combining the issuance, the Coca Cola deal was the second largest corporate Euro denominated issue ever.

- The fact that these issues were significantly oversubscribed.

What are the attractions of “Reverse Yankees”?

It is impossible to give examples of all of the attractions in this article but here are some:

| Attractions for the issuer | Attractions for the investor |

| Favorable financing cost when compared to the US Domestic Corporate Bond Market. Most of these issues have achieved a cost saving of between 1% and 1.5% per annum. | For a fund manager who is benchmarked, a small yield pickup without going down the credit spectrum. |

| A way to short the euro on a long term basis. | For a money market investor, by using an asset swap and an FX forward a way to earn a spread for the investor |

| A way of hedging balance sheet translation exposure. | |

| A way of hedging business economic exposure. |

Issuer hedging examples

Using a non-domestic currency to finance a business can lead to foreign exchange exposure unless the company issuing the debt has either a future receivable or an asset denominated in the currency of issue. In which case, the foreign exchange risk is eliminated because the company has both an asset and a liability denominated in foreign currency.

Take the case of Coca Cola. They have potentially four possible exposures to EUR-USD foreign exchange risk.

- Problem, short term receivables denominated in EUR – Coca Cola sells products into Europe, the proceeds of which are denominated in euros. If the euro falls from its current level of 1.10 to 1.00, a fall of 9.09%, Coca Cola will either have to increase its prices or suffer reduced profitability, or some combination of the two.

- Possible solution – borrow in euros, (the 2017 and 2019 maturity issues would work well here). Convert the euro proceeds of the bond issue into US dollars and use the US dollars for general working capital purposes. When the euros are received from sales of products, use them to pay coupons on the debt and place surplus euros on deposit to meet debt repayment in 2017 and 2019.

- Result – low cost finance and elimination of downside risk to EUR-USD.

- Possible disadvantage – no upside potential if the EUR-USD appreciates.

- Problem, longer term receivables denominated in EUR- Coca Cola has joint ventures which will pay dividends denominated in euros, which if the EUR depreciates, will be worth less in US dollar terms.

- Possible solution – borrow in euros (the 2023 maturity issue would work well here). Convert the euro proceeds of the bond issue into US dollars and use the US dollars for general working capital purposes. When the euro dividends are received, use them to pay coupons on the debt and place surplus euros on deposit to meet debt repayment in 2023.

- Result – low cost finance and elimination of downside risk to EUR-USD.

- Possible disadvantage – no upside potential if the EUR-USD appreciates.

- Problem, balance sheet translation exposure of assets denominated in EUR- Coca Cola has joint ventures and production facilities throughout Europe. The value of these assets will fluctuate in USD terms as the EUR-USD fluctuates. In this case we are looking at “translation” exposure rather than “transaction” exposure. It is not the intention of Coca Cola to sell these assets; however, their bottom line will suffer if the value of EUR-USD falls and it will be helped if the value of the EUR-USD rises.

- Possible solution – borrow in euros, (the 2027 and 2035 maturity issues would work well here). Convert the euro proceeds of the bond issue into US dollars and use the US dollars for general working capital purposes. Now Coca Cola has an asset (the joint ventures and production facilities) and a liability (the bond issues) which will both be sensitive to the value of the EUR-USD at year end, thus eliminating currency fluctuations, (or in accounting parlance translation—risk). On maturity of the bond issues, Coca Cola will have to decide whether to:

- Buy euros to repay the bond holders and re-introduce translation risk to the balance sheet.

- Issue another euro-denominated bond to renew the hedge.

- Result – low cost finance and elimination of downside risk to EUR-USD.

- Possible disadvantage – no upside potential if the EUR-USD appreciates.

- Possible solution – borrow in euros, (the 2027 and 2035 maturity issues would work well here). Convert the euro proceeds of the bond issue into US dollars and use the US dollars for general working capital purposes. Now Coca Cola has an asset (the joint ventures and production facilities) and a liability (the bond issues) which will both be sensitive to the value of the EUR-USD at year end, thus eliminating currency fluctuations, (or in accounting parlance translation—risk). On maturity of the bond issues, Coca Cola will have to decide whether to:

- Problem, can a weakening euro price Coca Cola out of a market? Coca Cola may have concerns about the long-term viability of a market because of a weakening of the markets currency. This will probably not be the case with the euro but if it were, a potential solution would be to borrow in euros.

Another way of using the proceeds of “Reverse Yankees” is with a bond issue and currency swap to raise US dollars. This may be slightly more problematical for two reasons:

First, banks may not be enthusiastic about longer term cross currency swaps because they are very capital intensive. However it may be possible to overcome this problem with reset clauses in the currency swap documentation.

Second, the basis swap may be trading too expensively and may neutralize the funding advantage of a bond and currency swap.

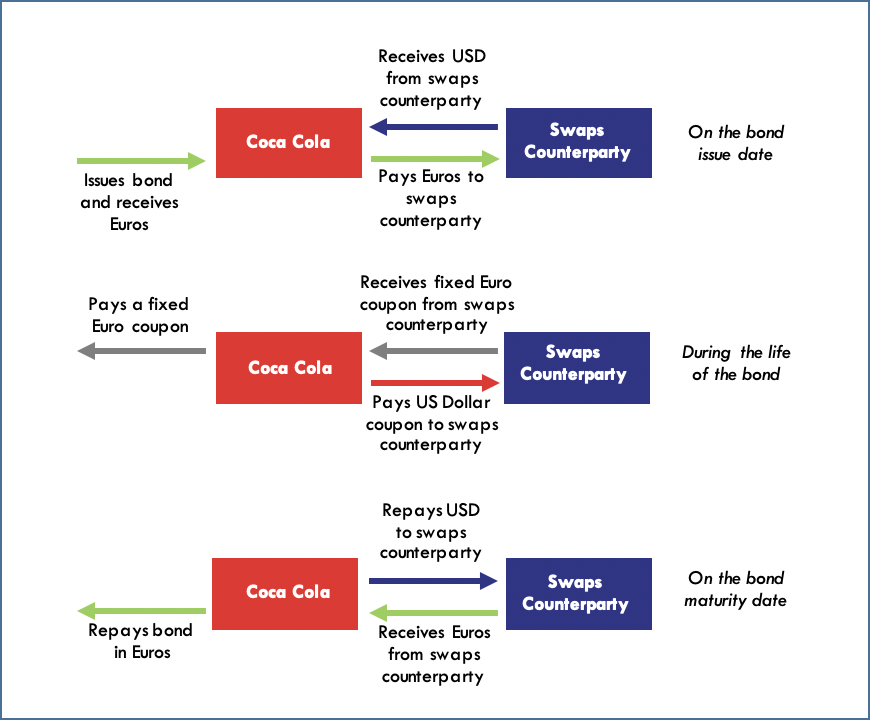

The following diagram explains how a bond and swap could be structured to raise US dollars through the issuance of a euro-denominated bond and a EUR-USD currency swap. Whether the bond coupon and the swap coupons are fixed or floating is a matter for negotiation, but both are possible. Usually the bond issuer would want to match all non-domestic currency cash flows.

From the Investors Perspective

This section examines choices from the investor’s perspective using the 2023 maturity 0.75% coupon bond which, for the sake of simplicity, I have assumed was purchased at a price of 100. From the investor’s perspective, here are two strategies that could be followed.

- I am a euro-denominated high grade fixed income fund. Keep the bond as a fixed coupon bond and earn an annual return of 0.75%.

Example of a fixed income fund manager – this type of fund manager is probably benchmarked to an index and is seeking to add a few basis points of additional yield. The advantage of this bond is that it allows the fund manager to earn the additional yield from a high grade (AA+) company.

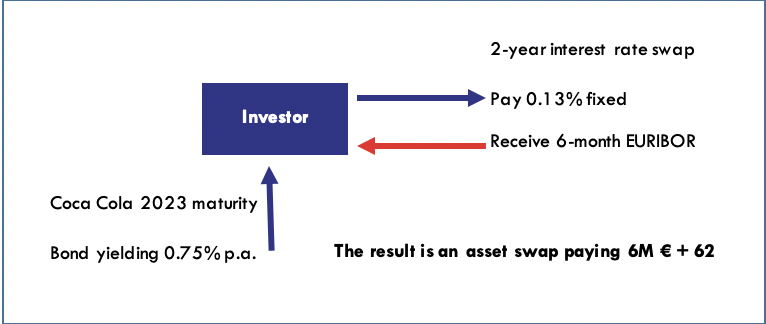

- I am a euro-denominated high grade money market fund. Asset swap the bond to earn EURIBOR plus a credit spread.

Example of a euro-denominated high grade money market fund – this type of fund manager is probably benchmarked to EURIBOR and is seeking to add a few basis points of additional yield. The advantage of this bond is that it allows the fund manager to earn the additional yield from a high grade (AA+) company, but needs to make the purchase on an asset swap basis. The example shows the result for the 2023 bond and a two-year maturity Euro denominated interest rate swap versus 6-month EURIBOR. The fixed rate is 0.13% p.a.

Is this what happened?

Yes, and I don’t know. The bond issues were actually completed at the coupons and maturities mentioned at the beginning of this article. The uses and investment strategies are certainly all possible with these bonds. However, I am not privy to Coca Cola Treasury so I cannot say ‘this was the motivation and how the proceeds were used’. Note: Coca Cola Treasury, please feel free to comment as I would love to hear your version of the events!

It’s a “win – win” situation!

Ok so who lost out then? In my humble opinion and doing a bit of time travel, I think that in two or three years’ time I would have preferred to have been the issuer rather than the investor. Time will tell, but until then let us have your thoughts!

About the author

With over 34 years’ experience in both the training fields and in finances, Robin is regarded as a leading edge trainer in numerous areas. He specializes in Fixed Income, Derivatives, Capital Markets, Risk Management, Structured Finance and Treasury Products. Robin has delivered programs in every major financial center on Asset and Liability Management, Risk Management, VaR, Credit Risk & Derivatives, and Financial Market Products.

With over 34 years’ experience in both the training fields and in finances, Robin is regarded as a leading edge trainer in numerous areas. He specializes in Fixed Income, Derivatives, Capital Markets, Risk Management, Structured Finance and Treasury Products. Robin has delivered programs in every major financial center on Asset and Liability Management, Risk Management, VaR, Credit Risk & Derivatives, and Financial Market Products.

Robin was the founding member of the London Inter-bank Currency Options Market, and he has sat on the BBA/Bank of England ICOM Committee. For more than three decades, Robin has held various positions in a number of commercial and international investment banks—covering roles in Treasury, Foreign Exchange, Structured Products, Equities and Derivatives. He also holds the ACI (Financial Markets) Diploma with Distinction.

Robin has written a number of computer software applications for use in the financial markets, specifically programs designed to price and analyze market risk in Fixed Income, Equity, Options and Structured Products. He has also authored a number of books covering a range of Capital Markets instruments. Robin’s next work will be entitled Bank Asset, Liability and Liquidity Management in a Basel III Framework and is scheduled for publication in late 2015.

Not one to rest much, Robin is the Chief Examiner for The Chartered Institute for Securities and Investments Bond and Fixed Interest Examination as well as a committee member of London chapter of The European Federation of Financial Analysts Societies (EFFAS) Bond Interest Group.

Copyright © 2015 by Global Financial Markets Institute, Inc.

Download article My Cart

My Cart