Introduction

First, we had, and still have, supply chain issues. These challenges have led to shortages of goods and the inevitable consequences of shortages – price increases. Sourcing products from overseas has been a decades long movement commonly referred to as globalization. Specifically, companies have offshored their production, i.e., they moved their operations overseas to achieve a cheaper production cost for their respective products. Alternatively, companies outsourced the production of their product to outside vendors that are also located overseas. These shortages and subsequent price increases have created an outcry for companies to onshore their operations, i.e., move the production of products to within the borders of the United States, with the goal to achieve a more secure supply chain.

Then, seemingly to come out of nowhere, there is a shortage of baby formula in the US, where 80% of the baby formula is made by two domestic companies, and 98% is domestically produced.1 Forgive me if I am confused. Will onshoring guarantee there are no future shortages of products at reasonable prices given this most recent development? Should companies seek the cheapest inputs into their products or should they create a more secure supply chain?

A Brief Historical Perspective of Globalization

Just-in-time (JIT) manufacturing started in Japan in the1970s. The concept was to meet consumer demand with minimum delays.2 Back then, cars were made in Japan. Today, Japanese auto manufacturers can be found globally. JIT manufacturing certainly has worked well since its introduction and not just for Japanese auto makers… until recently. But more of that in a moment.

During the same time period, China started opening their doors, along with Russia and other emerging markets. Trade agreements began to proliferate. Companies started offshoring/outsourcing their production to lower their input costs with a specific focus on lowering their labor costs (just ask the unions!).

Although tariffs have been around for decades, they had been reduced by the aforementioned trade agreements. Tariffs started being reimposed during the Trump administration and trade wars ensued, resulting in retaliatory tariffs imposed on the US. Not even Harley Davidson was spared!3

The Supply Chain Crisis

In early 2020, the COVID-19 pandemic hit. We now know that services, such as travel and restaurants, were hurt badly as people stopped dining in restaurants and stopped traveling, which led to major layoffs. Also, at the start of the pandemic, global factory production was cut back leading to large layoffs and the curtailing of durable goods. Simultaneously, people started working from home. This new work dynamic created demand for the same durable goods that global factories cut back on, such as microchips, cars, shoes and – yes – dumbbells, just to name a few products! Bottom line:

- There was less supply caused by shipping shortages, logistic issues, and covid challenges in general.

- There was more demand, especially from the US, given the economic stimulus package.4

Economics 101 tells us less supply and more demand will equal higher prices!

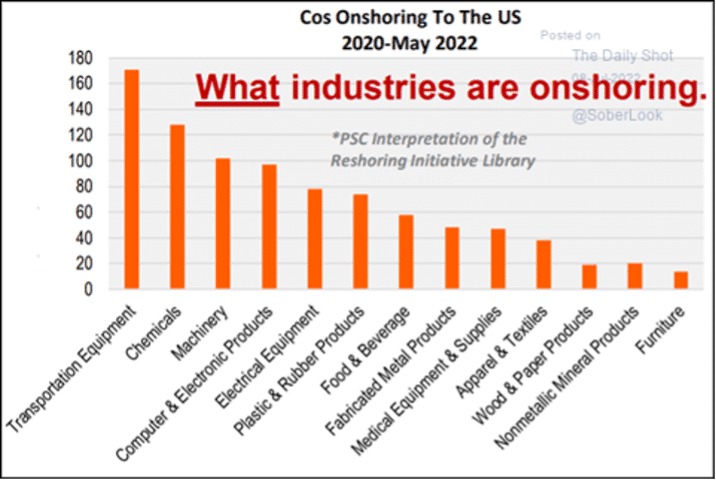

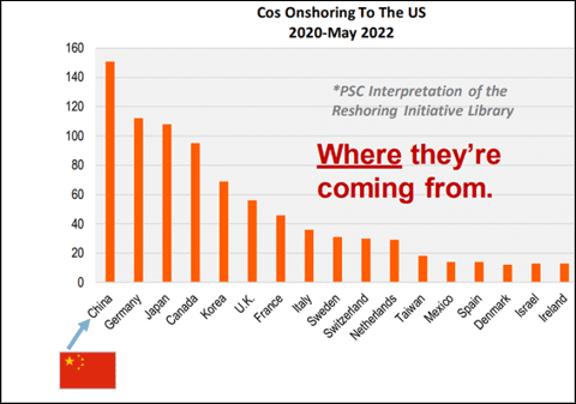

This led to outcries in the US that companies should not be offshoring, but rather onshoring, in order to make sure products are readily available regardless of costs. Here is a chart showing the state of onshoring:

“Manufacturing ‘onshoring’ has been picking up momentum.

Source: Piper Sandler

Source: Daily Shot July 8, 2022

Baby Formula Shortage

Next up, the baby formula shortage occurs. As already mentioned, the intriguing aspect about the baby formula shortage is the fact that 98% of product is made within the borders of the US. That statistic alone raises a red flag about a product being produced within the borders of the US. Specifically, if onshoring is the answer to product shortages, why then is there a baby formula shortage when the product is almost 100% produced in the US? Here are the reasons often cited for the shortage:

- One of the production facilities at Abbott was shut down. This one facility accounts for 20% of the US production of baby formula. We don’t need an economics degree to determine the potential for shortages when 1/5th of the supply of a product is removed.5

- Regulatory barriers and steep tariffs exist where the tariffs are as high as 17.5%.5,6

- As mentioned, 98% of the baby formula is made within the US borders but the producers are highly concentrated. In fact, three companies produce 98% of the product, which, by definition, is an oligopoly (and we thought the Russian oligopolies were the only ones making the news!).6

The FDA is responsible for regulating infant formula. It is a sprawling government agency regulating, food, drugs (prescription and non-prescription), biologics, medical devices, electronic products, cosmetics, veterinary products and tobacco.7 That is a lot for one agency to oversee. It is not surprising, and indeed regrettable, that they missed the signals of a potential shortage given the impact on the health of so many babies and the stress on US parents trying to find formula for their children.

Will this also occur in other industries as more and more onshoring occurs? Is the federal government, specifically the FDA, too much of a bureaucracy to deal with another potential crisis? Where and when will bureaucracy become an issue if the production of all products is brought back within the borders of the US?

And what about the tariffs and trade wars? The baby formula shortage showed that other countries maintained the same high level of safety in producing baby formula as that in the US If they weren’t at the same standards, then why were these companies allowed to ship their baby formula to the US during the emergency? And why is there a 17.5% tariff on baby formula? History has certainly shown that trade has lowered the costs of goods for many products.

A last thought, will domestic oligopolies or even monopolies control prices thereby pushing inflation even higher?

Summary

There are several reasons for both the supply chain crisis and the baby formula shortage. Although the pandemic created supply and demand challenges, it seems government intervention, regulation, and tariffs will continue to play a role in future challenges regardless of the product at the heart of the challenge. The answer is not necessarily 100% onshoring or 100% offshoring, but similar to the current work at home versus work in the office debate, the onshoring/offshoring answer will likely be a hybrid solution.

References

1 The Baby Formula Shortage and Bad Governance, Wall Street Journal May 24, 2022 https://www.wsj.com/articles/baby-formula-shortage-bad-governance-biden-approval-fda-food-and-drug-administration-europe-imports-11653405998

2 https://www.ifm.eng.cam.ac.uk/research/dstools/jit-just-in-time-manufacturing/

3 https://www.piie.com/blogs/trade-investment-policy-watch/trump-trade-war-china-date-guide

4 For a timeline and explanation of the supply chain issues see the following NY Times Article: https://www.nytimes.com/interactive/2021/12/05/business/economy/supply-chain.html

5 See footnote 1

6 https://www.americanprogress.org/article/the-national-baby-formula-shortage-and-the-inequitable-u-s-food-system/

7 Go to https://www.fda.gov/about-fda/fda-basics/what-does-fda-regulate more information on the FDA.

Research

https://www.wsj.com/articles/baby-formula-shortage-bad-governance-biden-approval-fda-food-and-drug-administration-europe-imports-11653405998?mod=Searchresults_pos16&page=1

About the Author: Kenneth Kapner

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Publications and Articles

Articles

2022 CME Cryptocurrency Futures

2021 The Federal Reserve’s Tools to Manage Monetary Policy and Everything You Wanted to Know About Inflation but Were Afraid to Ask

2020 Modern Monetary Theory: The Federal Reserve, Inflation, and the US Dollar

2019 3-Month SOFR Futures and LIBOR Schmibor: What’s Next? SOFR Part I and Part II

2018 VIX, Volatilities, and Exchange Traded Products and Settlement Risk and Blockchain

2017 Electronic Trading and Flash Crashes – Part I and Part II

2016 The Long and Short of IT: An Overview of XVA, The Long and Short of IT: An Overview STACR and CAS, The Federal Reserve Tolls: Past and Present, The Perfect Storm: October 2008, and Interest Rate Swap Futures: An Introduction

2014 Risk Reversals

2002 Futures Magazine, Doing Your Homework on Individual Equity Futures (Co-written with Robert McDonough)

Blog

Ken also edits and writes for the GFMI Blog.

Books

1996 Como Entender Los Swaps (co-author: John Marshall), published by CECSA (a Mexican publishing firm). This is a translated edition of our book Understanding Swaps, but with adaptations to fit the Mexican markets. (289 pages)

1993 The Swaps Market: 2nd edition, Kolb Publishing, 288 pages (co-author: John Marshall, copyright 1993). This book is directed to the graduate business student.

1993 Understanding Swaps, John Wiley & Sons, 270 pages (co-author John Marshall, copyright 1993). This book is directed to the practitioner market and is published as part of Wiley’s Finance Series.

1993 1993-94 Supplement to the Swaps Handbook, New York Institute of Finance, a Simon & Schuster Company, 494 pages, (co-authors John Marshall and Ellen Lonergan, copyright 1993). This book is directed to a practitioner audience and is a supplement to The Swaps Handbook. My role was largely that of editor.

1991 1991-92 Supplement to The Swaps Handbook, New York Institute of Finance (Simon & Schuster Professional Information Group), 300+ pages (co-author: John Marshall copyright 1992). This book is directed to a professional practitioner audience and is an annual supplement to The Swaps Handbook.

1990 The Swaps Handbook: Swaps and Related Risk Management Instruments, New York: New York Institute of Finance, a Simon & Schuster Company, 543 pages. (co-author: John Marshall). This book is directed to derivative product professionals.

1988 Understanding Swap Finance, Cincinnati: South Western publishing Company, 155 pages. (co-author John Marshall, copyright 1990). This was the first academic text published on the swaps markets.

Affiliations

International Association of Financial Engineers Board of Advisors – 1994 – 2010

Global Association of Risk Professionals

ATD National and New York Chapters

Copyright © 2022 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

My Cart

My Cart