Déjà Vu All Over Again

When the Affordable Care Act (ACA) was passed in 2010, it promised to provide Americans with better access, better outcomes, and reduced costs for our healthcare.i Great news!Of course, it would take some time to have it all implemented. There could be changes in delivery methodology.Healthcare systems would need to restructure, consolidate, and manage their organizations in a more strategic and business-like manner.As a close follower of the healthcare industry, I wasn’t surprised when I recently found an article in Health Affairs with some important observations: “During the past fifteen years, the hospital industry has undergone dramatic structural and behavioral changes. The most dramatic relates to the proliferation of multiple hospital systems… A second dramatic change relates to the greater prominence given the ‘Business Ethic’ within the hospital industry.Changes in the environment have created demand for…access to capital…, more attention to competition and profit margins in the long-run financing of any organization”.ii I understood!This is exactly what I’ve seen!Uhm, then I noticed the date of the article –Spring 1983.Yes, evolution and change in delivery approaches describe this industry and have done so for many years.The structural and behavioral changes continue. So, if you are assessing risk as you lend to, or invest in this dynamic industry, you will need to understand the complex system and follow regulatory, policy, and market changes closely.Even more important: to identify the unique characteristics of the entity you are evaluating.

How Did We Get Here?

In the US, we have a very loosely structured healthcare delivery system.Unlike many other countries, we never set up a structured system with an overt public health objective.Yet, there were six presidents prior to Obama, both Democrats and Republicans, who strongly supported a more universal type delivery system.In each case they were shut down by Congress orbysome other impediment to their policy proposals.Meanwhile, the various parts of the healthcare delivery system evolved on their own, with often conflicting objectives.Understanding the components, and that evolution, is critical to understanding specific healthcare enterprises.

A brief summary:

1. Hospitals became places for healing in the early 20th century. Services were initially paid for privately until employee health insurance coverage became widespread and Medicare and

© Global Financial Markets Institute, Inc.Page 2of 8Medicaid were implemented. Hospitals expanded rapidly after WWII with the help of federal subsidies.

2. Health insurance through employers became available in 1942 as a tool to entice employees during FDR’s wartime wage freeze. These benefits became even more attractive after the IRS ruled that they were exempt from taxes. Medicare and Medicaid funding became available in 1965, with recognitionthat the retired and poor populations, without employment, did not have access to insurance. Medicare was further expanded in the 1970s. Initially employer insurance paid providers on a fee-for-service basis, with Medicare on a cost basis.

3. Physicians initially were solo practitioners, privately paid, until commercial and federal insurance was implemented.iii

Expanding public and private insurance coverage initiated the era of large and growing expenditures, primarily due to price increases in hospitals, physicians, and pharmaceuticals. These increases were driven by fee-for-service methodology for private insurance and a good deal of creative accounting on the side of cost reimbursed federal programs. As the following graphic illustrates, health expenditures grew from about 5% percent of US GDP in 1960, to 7% in 1970, and to 9% in 1980. Today it is 18%.iv

![]()

The government recognized the problem of increasing costs by the late-1970s, along with the lack of consistency in cost for the same procedure or illness in different locations or settings. To address this, Congress passed legislation initiating a prospective payment system (PPS) for Medicare payments in 1983.Private insurers soon followed suit.This was initially for hospital inpatient stays and phased into institutions over a four-year period.It was based on the information available and true cost could not really be identified. PPS was gradually expanded to cover capital costs, home health, outpatient, and other costs and services through the 1980s and 1990s.Each year, hospital revenues could change –due to the new payment structure and its menu of payments for various services.The cost containment strategy was underway.Healthcare systems needed to manage their businesses differently. They developed strategies to provide, or eliminate, services based on reimbursement or cost considerations. New challenges and opportunities cropped up each year.Despite decades of efforts to impose private sector efficiency in the industry, spending has not been contained; it continues to grow.Disparity in charges continues among providers across the country, in similar regions, and even in the same facility.It results from the industry’s haphazard development and evolution, with various pieces driven by different, and often conflicting, objectives.Profit is often still the primary objective.The challenges and opportunities continue. The initiative to cut costs via the Affordable Care Act was combined with the effort to both increase coverage and improve quality of care.Meanwhile, the aging population continues to contribute to the growth in healthcare expenditures.Sophisticated providers adapt to address their own objectives, within the rules.The bottom line? Meeting the objectives within the ACA is a Herculean effort.

Don’t Lose Sight of the Forest for the Trees

In more than three decades of professionally following the healthcare and hospitals industry, I have watched multiple changes unfold.There have been reactive and proactive changes by providers, who are trying to adhere to new rules and regulations while maintaining their earnings.Some have changed strategically and are thriving.Others have waited until a storm was on the horizon to scramble,or worse, get swept away in the upheaval.Understanding the cause and drivers–of any change–is required to assess the credit quality and opportunities of any provider.Minutia may be consuming management, but what does the entity’s bigger picture portray? What is their market, demographics, strategies,and constraints?Do you see the same picture that leadership does?

Who’s Picking Up the Tab?

Healthcare spending in the United States amounted to $3.5 trillion in 2017, and $3.6 trillion in 2018.Yikes!

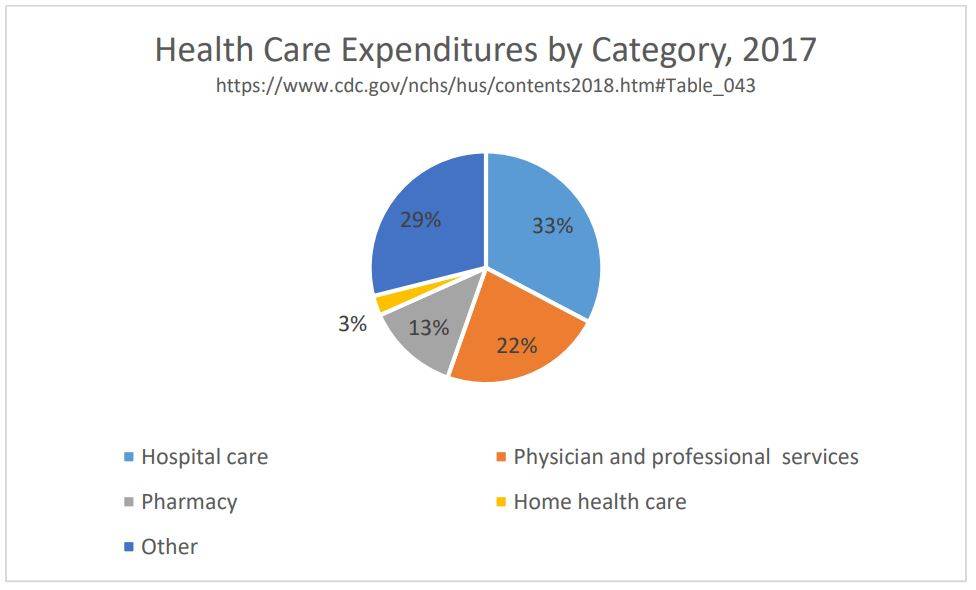

Pricing is a major factor in our costs, along withhigh use of diagnostic tests and treatments, defensive medicine, high administrative costs, and an aging population. As shown in the pie chart that follows, over 70% of the healthcare dollar goes to hospital care, physicians and clinics, home health care, and pharmaceuticals.v Much of this is controlled, today, by healthcare systems and affiliates.

So, who is paying for all this healthcare?

Nearly half of healthcare expenditures are paid by the federal government through Medicare, Medicaid/Chip (federal portion, which is over 50% of cost), benefits, tax incentives, and other support–which comes to nearly 9% of the US GDP.Private health insurance pays about 34% of expenditures, states are responsible for about 8% through Medicaid and other contributions, while self-pay is about 10%.vi

Where Are We Today?

The American healthcare system is both a leader and a laggard.According to Newsweek, the US claimed four of the world’s top ten hospitals in 2019.vii There are many other top-quality hospitals, clinics, and physicians across the country. This high-quality level of care is available to those with good, comprehensive health insurance, or to those with the private financial resources in order to access the best care.

Some of the world’s best technology and cutting-edge,ongoing research for a range of illnesses and conditions exists in the US today. Yet, even after the passage of the ACA in 2010, 8.5% of Americans still lack health insurance coverage for quality care. It’s a remarkable expansion in coverage relative to the 17.8 % without coverage in 2010, but still below the standard of universal, or near universal, care achieved in other developed economies.

The US spends about 18% of its GDP on healthcare, roughly double the average expenditures of other OECD nations. Expenditures grew 4.6 % in 2018, and estimates have it at about the same growth level in 2019.Factors contributing to this include the high cost of pharmaceuticals, administrative costs, and physician salaries.viii Life expectancy in the US is 78.6 years, trailing the average of other industrialized nations by nearly four years. However, doubling of life expectancy in the last 200 years can largely be attributed to improvements in basic sanitation and antibiotics.ix

The current level of expenditure and growth will be difficult to sustain. Yet, we must maintain quality and access.The more recent initiatives by payors to rein in costs include value-based or bundled payments.This type of funding pays for overall treatment of a specific illness or treatment, rather than paying for each service in the treatment individually.While this method can work well for the population at large, it is challenging for the very ill or those with rare conditions.Today, about half of expenditures are used by the top 5% of patients.x

The market response to changes, particularly since passage of the ACA, has been a wave of consolidations and formations of large healthcare systems, along with changes in health delivery methodology.The systems are becoming more integrated, both vertically and horizontally. Healthcare systems are emerging with more hospitals, physician employees, and small insurers.There may also be a change in accountability, with respect to who is assuming the cost risk.xi

Risky Business

Is this a risky business, or just one where industry knowledge, risk identification, and careful selection must be made?It must be understood that all hospitals and healthcare systems are subject to Federal, State, and local payment, regulatory, and market conditions.Given the demographics of the US, and the portion of our economy driven by healthcare expenditures, healthcare services and hospital systems will continue to be significant.In this capital-intensive industry, there will also continue to be funding needs for routine capital expenditures, along with investment in new technology and expansion. The change is the different manner in which healthcare services are delivered and paid.

There are some especially important considerations and questions that must be analyzed when evaluating risks at a hospital or health system including:

- What is the corporate structure?

- What are the financial metrics? It may be difficult to identify “standard” measures.Combining the metrics, along with numerous qualitative factors, assists in the risk evaluation. Metrics include:

- Profitability –Operating margin, EBIDA margin

- Leverage –Funded debt/funded debt + net assets, funded debt/EBITDA

- Liquidity –Unrestricted cash and investments/debt, days cash on hand (DCOH)

In the healthcare industry, financial metrics provide a good starting point.However, facilities may differ from “peers” due to local competitive factors, regulatory considerations, and corporate structure and affiliations.

- What is the payer mix? Are any subsidies provided to revenue?

- Understand the Medicare methodology used.Certain hospital classifications provide for different Medicare reimbursement methodology.

- How is Medicaid managed in this State? Who are the commercial insurers?How is each managed and paid?

- What are other non-hospital affiliates in the healthcare system?

- Does the system employ the physicians, or own practices, or are the physicians independent providers?Is recruiting physicians, nurses,or other staffing problematic?

- How are cash and cash flow within the system managed?

- Are there any significant legal or clinical issues identified or being addressed?

- Management: What is their history, strategy, and ability to implement change?

Where Are We Going?

The only certainty is that our healthcare system is going to continue to evolve.The ACA objectives, and many changes that have been put in place, represent progress.The ability to implement all elements has been limited, because some states have challenged the requirements to implement the law, and many of the proposed beneficiaries are unable to understand or access the available insurance plans.As a financier, there continue to be opportunities.During the last 50 years of ongoing reimbursement changes, the strong providers have adapted well, and many entrepreneurs have become rich.xii Well-informed investors and lenders can find opportunities in the stronger providers… as well as discovering a few diamonds in the rough!

About the Author: Ann Dodd

With 30+ years of financial services experience, combined with problem solving, needs analysis, writing and communications skills, Ann Dodd provides the expertise to plan and structure solutions to achieve measurable goals. She has a proven, consistent record of establishing mutually beneficial relationships in sales; comprehensive expertise in financial solutions and products; and exceptional leadership and management skills.

Ann has designed and facilitated learning programs in credit; pension and 403b plans, and financial management. She has also worked on the development of Basel II compliant internal grading scorecards, and has been a subject matter expert for numerous specialized industry scorecards due to their unique credit characteristics. She has led teams of credit professionals in risk assessment of loan portfolios for sale, and assisted with credit asset reviews for banks. In addition to her own consulting business, Riosca Training and Consulting, Ann has extensive financial services experience with Wells Fargo Corporation where she managed and approved credit risk for clients in both the Corporate and Investment Banking Healthcare and the Not-for-Profit Healthcare groups; Toronto Dominion Bank where she was a Senior Credit Officer in Corporate Banking; and Bankers Trust where she was trained and started her banking career.

Copyright © 2020

by Global Financial Markets Institute, Inc.23 Maytime Ct

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

i https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3698736/ June 2013

ii https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2.1.25

iii Reinventing American Health Care, Ezekial Emanuel, Public Affairs 2014

vii https://www.newsweek.com/best-hospitals-2019

viii https://jamanetwork.com/journals/jama/fullarticle/2674671

ix https://sjbpublichealth.org/200-years-public-health-doubled-life-expectancy, https://data.oecd.org/healthstat/life-expectancy-at-birth.htm

xi https://www.medicaleconomics.com/business/surviving-merger-mania

xii https://www.businessinsider.com/10-richest-healthcare-and-biotech-execs-2018

Download article My Cart

My Cart