Introduction to Counterparty Credit Risk

The evolution of counterparty credit risk started with counterparty (credit) limits, settlement limits and exposure measurements such as potential future exposure. This progressed to the use of unilateral collateral, then the bilateral exchange of collateral. To assist in the pricing for the cost of dealing with a counterparty in a derivative transaction, the markets have developed a family of metrics including CVA, DVA, FVA, ColVA, KVA, and MVA, which have now been collectively dubbed XVA (xVA). And of course, the most important metric of all: “Oy vey”!! (For a definition of Oy vey go to https://en.wikipedia.org/wiki/Oy_vey.) The icing on the cake, or maybe still building the cake, is that the Bank for International Settlements (BIS) recently announced their intention of removing one of the approved methods for calculating CVA for capital charges.

What is CVA and All the Other VAs?

According to the BIS Consultative document1 “CVA is an adjustment to the fair value (or price) of derivative instruments to account for counterparty credit risk (CCR). Thus, CVA (Credit Value Adjustment) is commonly viewed as the price of CCR.” JP Morgan goes on to say, “As few classes of derivative contracts are listed on an exchange, derivative positions are predominantly valued using models that use as their basis observable market parameters. An adjustment therefore may be necessary to reflect the credit quality of each derivative counterparty to arrive at fair value.”2

The challenge is that the acronym CVA gets thrown around a lot. Let’s look at an example to illustrate this point. Assume Dealer Bank (DB) enters into an interest rate swap with a client where the DB pays fixed and receives floating as shown below:

The payment or premium to the DB CVA Deskis the cost associated with the counterparty credit risk. (In the beginning stages of evolution, it was called a CVA Desk; however, to encompass all of the adjustments it may be referred to as an “XVA Desk,” but we will stick to CVA for this article.)The CVA in this example is the incremental charge or cost of the credit risk of the client to DB in the trade. The CVA Desk is then responsible for managing the CCR as well as the capital requirements under Basel (specifically to minimize capital!). CVA can therefore refer to:

- The charge for the cost of CCR which is a function of the estimated positive exposure, i.e., what is estimated to be owed to DB in the future, adjusted for client’s probability of default, and the exposure at the time of default and recovery rate. (This is an oversimplification as most likely there will be, with the same counterparty, netting and collateral agreements in place, multiple transactions and correlations across asset classes; wrong way risk may also be taken into account.)

- The cost incurred by the CVA desk to hedge the CCR exposure.

- Part of the new Basel III capital rules, i.e., more capital is required against the counterparties potentially going bankrupt.

- From a financial statement standpoint, CCR can be viewed in aggregate as a reduction in derivatives receivables as the potential of counterparties not meeting their contractual obligations.

Debt Value Adjustment (DVA)

DVA or Debt Value Adjustment (some folks in the market might substitute the word “valuation” for “value” for any one of the XVAs) is the opposite of CVA. However, it is DB’s own assessment on themselves and not the counterparty’s assessment of DB. Similar to CVA, it is a function of the estimated negative exposure, i.e., the estimated amount that DB owes the counterparty in the future, DB’s own probability of default, exposure at time of default and recovery rate. Again it is DB’s own analysis on themselves.

Funding Value Adjustment (FVA)

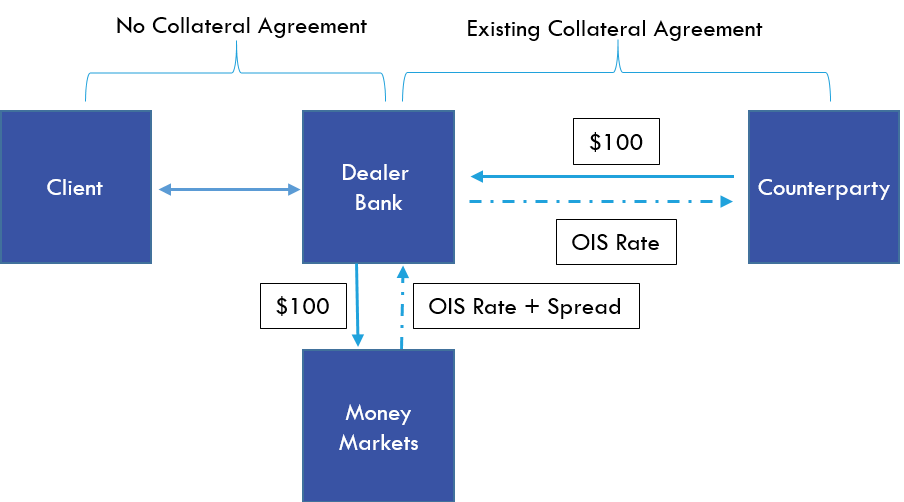

FVA or Funding Value Adjustment attempts to capture the funding of the Over the Counter (OTC) derivative trades for mismatched or imperfect collateralization. For example, assume that DB enters into a transaction, such as a plain vanilla interest rate swap, with a client and there is no collateral agreement in place. To hedge this transaction, the DB will enter into an offsetting transaction that matches the exact details of the client trade, with a counterparty where there is an established collateral agreement without thresholds. Assume after one day the client transaction is in a positive mark-to-market (MTM) of USD 100. That implies that the offsetting transaction is out of the money or has a negative MTM of USD 100. DB is required to make a collateral transfer of USD 100 to the counterparty. Assuming these are the only two deals on DB’s books, then they will have to fund the collateral transfer.

Collateral Agreements

Collateral agreements, sometimes known as credit support documents (CSD) or credit support annexes (CSAs), generally call for an interest payment if the collateral is cash. Therefore, the counterparty will pay a rate of interest known as the Overnight Index Swap Rate (OIS). For example, in the U.S., this is the geometric average of the overnight fed funds rate. This sounds good but if the cost of funds to raise the $100 is greater than the OIS rate, then there is a cost to this portion of the transaction. This is shown in the following illustration:

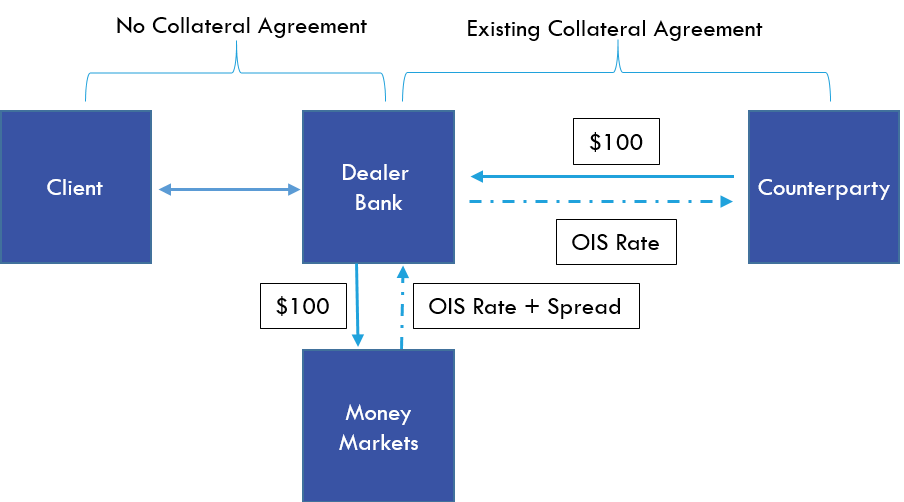

Now assume the client transaction has a negative exposure to DB and the hedging transaction has a positive exposure for DB. In this case, the counterparty will transfer the $100 to DB which is illustrated below:

This results in a funding benefit to DB.

This approach is again overly simplified. Banks manage the various market risks at a portfolio level and not at the individual transaction level. Other factors may play a role as well such as a change in terms of the CSA. Further, a major assumption in the above example is that the collateral is legally allowed to be re-hypothecated.

The bottom line is that the derivatives business is based on a set of cash flows including collateral. When all is said and done, if more money is going out than coming in, it has to be funded. If that funding rate is higher than the rate DB is receiving, it is going to be a cost and vice versa! Often these funding/lending requirements will be fulfilled through an internal centralized Treasury at a rate known as the transfer pricing rate or TPR. The TPR will most likely be some blended rate where the bank can borrow/lend in the marketplace.

Margin Value Adjustment (MVA)

MVA or Margin Value Adjustment is the cost of funding the initial margin for a cleared or bilateral transaction. (Some discussions have added in the variation margin cost/benefit to the MVA.) OTC derivatives clearinghouses are well established at this point. However, starting in September 2016, OTC derivatives that are not centrally cleared will also require initial and variation margin. For more on this, see BCBS-IOSCO: “Margin Requirements for Non-Centrally Cleared Derivatives”3. Many, if not all, of the largest banks have these bilateral agreements in place.

Central Counterparties (CCPs), will generally determine the initial margin as a function of Value at Risk (VaR). (The specific methodology to calculate VaR is not covered in this article.) Alternatively, expected shortfall may be used. The MVA is a function of the Expected Initial Margin (EIM), the borrowing cost or more succinctly the spread over some benchmark such as OIS and joint survival probability of the CCP/counterparty and institution. This would be a negative adjustment to the price of the transaction.

Capital Value Adjustment (KVA)

KVA or capital value adjustment refers to the cost to raise the capital for the counterparty credit risk associated with a transaction over the life of the transaction. Regulatory capital requirements arise from Basel II to capture default and migration risk and Basel III to capture the variability in CVA.

KVA is a function of the estimated capital and, similar to above, the cost of capital and probability of survival. Estimating capital is challenging as regulatory capital requirements can change. A perfect example of this is the prospect of regulators not allowing the use of the Internal Model Method (IMM) for capital calculations. Further, there does not seem to be any convention for the calculation leading to greater disparity in the final adjustment between counterparties.

Other regulatory challenges include funding costs for the supplemental leverage ratio, liquidity coverage ratio, and net stable funding ratio.

It is interesting to note that from a traditional asset and liability management (ALM-We thought you needed another acronym!) perspective, funding and liquidity go hand in hand.

Collateral Value Adjustment (ColVA)

Our final term is ColVA or collateral value adjustment. In an ideal world this adjustment would not be necessary. For example, assume that collateral would be transferred, in real time, as the mark to market changed throughout the day. Assuming this was cash, and the same rate was paid bilaterally, then there would be no need for any adjustments. Further assume there was no initial margin. This seems to be close to a perfect collateral agreement! However, in practice there is initial margin, there are minimum thresholds when collateral is exchanged, and cash is not always used. In general, to determine the ColVA, the expected collateral balance has to be estimated and, similar to some of the other VAs, the survival probability and the spread over some benchmark rate, e.g., the OIS, will be used to calculate the adjustment.

It is generally accepted that OIS is used in the vast majority of the cases to discount future cash flows in plain vanilla derivatives, e.g., interest rate swaps. (It is more complicated when the derivative involves two currencies.) If the remuneration on the collateral is different than the discount rate, then an adjustment will be made.

Further, if non-cash collateral or other currencies are used, the picture becomes more complicated. Much will be determined by the agreement between the two counterparties. Generally speaking there will be optionality involved. That is, one counterparty will have various choices and will attempt to maximize their return in terms of the collateral being delivered. Simplistically the counterparty will attempt to earn the highest rate of return in another currency. If the counterparty chooses to deliver a security/non-cash collateral, then they will go the cheapest to deliver route, i.e., choose the security that will cost them the least amount of money after considering such aspects as haircuts.

Pricing Adjustments

As you can see there are quite a number of adjustments that are applied to pricing. CVA, DVA and FVA are now ensconced in the market. MVA, KVA and ColVA are still evolving. Trying to understand all of these XVAs is one big Oy Vey!

Footnotes

1http://www.bis.org/bcbs/publ/d325.pdf),

2JP Morgan 2014 annual report pdf page 196

3 http://www.bis.org/bcbs/publ/d317.htm

References

Gregory, Jon., The xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalThird Edition, Wiley Finance Series 2015

Ruiz, Ignacio., XVA Desks – A New Era for Risk Management: Understanding, Building and Managing Counterparty, Funding and Capital Risk, Palgrave Macmillan 2015

About the Author: Ken Kapner

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

Ken Kapner, CEO and President, started Global Financial Markets Institute, Inc. (GFMI) a NASBA certified financial learning and consulting boutique, in 1998. For over two decades, Ken has designed, developed and delivered custom instructor led training courses for a variety of clients including most Federal Government Regulators, Asset Managers, Banks, and Insurance Companies as well as a variety of support functions for these clients. Ken is well-versed in most aspects of the Capital Markets. His specific areas of expertise include derivative products, risk management, foreign exchange, fixed income, structured finance, and portfolio management.

He has been a Risk Management Advisor to a Mutual Fund’s Board of Trustees and has served as an Expert Witness using knowledge of derivatives, trading and risk management.

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Publications

Articles

“Doing Your Homework on Individual Equity Futures”; Futures Magazine, March 2002 (with Robert McDonough)

Books

1996 Como Entender Los Swaps, (co-author: John Marshall), published by CECSA (a Mexican publishing firm). This is a translated edition of our book Understanding Swaps, but with adaptations to fit the Mexican markets. (289 pages)

1993 The Swaps Market: 2nd edition, Kolb Publishing, 288 pages (co-author: John Marshall, © 1993). This book is directed to the graduate business student.

1993 Understanding Swaps, John Wiley & Sons, 270 pages (co-author John Marshall, © 1993). This book is directed to the practitioner market and is published as part of Wiley’s Finance Series.

1993 1993-94 Supplement to the Swaps Handbook, New York Institute of Finance, a Simon & Schuster Company, 494 pages, (co-authors John Marshall and Ellen Lonergan, © 1993). This book is directed to a practitioner audience and is a supplement to The Swaps Handbook. My role was largely that of editor.

1991 1991-92 Supplement to The Swaps Handbook, New York Institute of Finance (Simon & Schuster Professional Information Group), 300+ pages (co-author: John Marshall © 1992). This book is directed to a professional practitioner audience and is an annual supplement to The Swaps Handbook.

1990 The Swaps Handbook: Swaps and Related Risk Management Instruments, New York: New York Institute of Finance, a Simon & Schuster Company, 543 pages. (co-author: John Marshall). This book is directed to derivative product professionals.

1988 Understanding Swap Finance, Cincinnati: South Western publishing Company, 155 pages. (co-author John Marshall, © 1990). This was the first academic text published on the swaps markets.

Affiliations

International Association of Financial Engineers, Board of Advisors (1994 – 2010)

Global Association of Risk Professionals

ASTD National and New York Chapters

About the Author: Charles Gates

Charles Gates is a Managing Director at eDelta Consulting and has over 30 years’ experience in investment and commercial banking, derivatives, foreign exchange, capital markets, hedge funds, and credit, market and operational risk management consulting. As a consultant and trainer, he has developed and presented learning events worldwide with many major investment banks, insurance firms, international banks, and regulatory agencies.

Charles Gates is a Managing Director at eDelta Consulting and has over 30 years’ experience in investment and commercial banking, derivatives, foreign exchange, capital markets, hedge funds, and credit, market and operational risk management consulting. As a consultant and trainer, he has developed and presented learning events worldwide with many major investment banks, insurance firms, international banks, and regulatory agencies.

Charles began his career as a multinational lending officer for Citibank, after which he became a founder of Citi’s derivatives business. He completed many “first time” derivatives transactions for Citi, including its first interest rate swap in the United States, and helped the World Bank develop its swap program. Subsequently, he was global head and a founder of First Chicago’s currency swap business, SG Warburg’s international private placement and gold advisory, and Rabobank’s credit derivatives business, completing over $12 billion in credit derivative transactions. Charles served as Co-Head of the Credit Risk Management practice of Deloitte & Touche, a Senior Vice President of FRM (a premier global fund of hedge funds now part of Man Group), and a Managing Director of Grammer and Co. He has completed multiple expert witness assignments.

Charles has been a talent development professional throughout his career, covering topics such as credit analysis, process and presentation skills, capital markets and derivatives across the major asset classes of interest rates, foreign exchange, equities, commodities, hedge funds and credit (credit derivatives). He has taught client relationship building and marketing, leadership development, and is an executive coach, and a career coach at Columbia Business School.

He wrote “Building the Organization to Support the 130/30 Opportunity” for the prime brokerage consultancy of a major US investment bank, published in the Journal of Investing, and has been featured in Euromoneymagazine.

Charles is a member of GARP, FIASI, and ATD. He holds an MBA, cum laude, from Columbia Business School, and a BA, cum laude, from Yale.

Copyright © 2016 by Global Financial Markets Institute, Inc.

Download article My Cart

My Cart