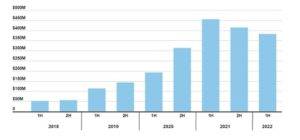

Trends in Sustainable Security Issuance

The number and total size of new issuance deals in the sustainable (or ESG, or Impact) security space has been consistently growing over the past decade around the globe. Even the COVID pandemic was not sufficient to diminish the need for new capital to fund projects and initiatives targeting environmental sustainability with positive social impact. However, new issuance began to diminish in the second half of 2021 and into 2022, primarily driven by geopolitical events such as the Russian invasion of Ukraine and the subsequent increase in volatility in commodities markets, particularly in the energy sector.

Global Impact Bond Issuance Through 2022H1 ($)

Source: ICE Impact Bond Analysis Q2 2022

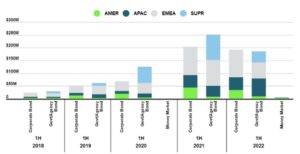

Europe and Asia continued to lead the way in new issuance, although growth in the US was healthy as well, at least until the deterioration in the political environment began to accelerate in early 2022. Around the globe, sovereign and quasi-governmental entities drove most of the new issuance volumes, followed closely by the corporate sector.

Issuance by Issuer Type Through 2022H1 ($)

Source: ICE Impact Bond Analysis Q2 2022

Sustainable Securities

Although ESG (or sustainable) securities were described in a prior article, a brief summary of the most common types of these instruments are presented below:

Issuers of ESG-labeled bonds have aligned the terms of their securities with widely recognized sustainability standards such as the International Capital Market Association’s (ICMA) Green, Social or Sustainable Bond Principles. Unlabeled ESG securities are either inherently aligned with ESG (such as bonds issued to finance the construction of solar panels or affordable housing) or are otherwise “self-designated” as ESG-aligned by the issuers themselves.

Social bonds are generally issued to achieve certain socially desirable outcomes such as providing financing for affordable residential and commercial housing projects or health care or medical facilities.

Sustainability-Linked Bonds are securities that are designed to provide funds for sustainable (green or social) projects, while at the same time having structural features that provide strong incentives to direct these funds to specific projects instead of being used for general corporate purposes.

Greenwashing

“Greenwashing” is the term most frequently used to describe the practice of making claims about products or services that suggest they contribute more to environmental sustainability than they actually do. This practice is essentially an attempt to convince stakeholders that the issuer of a security is taking steps to ensure their activities have a positive environmental impact, often by using terminology which is so generic as to have no real meaning, thereby allowing the issuer to avoid any real responsibility to ensure their activities have outcomes that align with a more environmentally sustainable future. The term “greenwashing” is also increasingly used to comprise unrealistic statements about the positive societal impact of issuer actions and is therefore not strictly used in an environmental or climate-related context.

The expression “greenwashing” is not a 21st-century concept – it was first used in a 1986 essay written by environmentalist Jay Westerveld. This essay pointed out the somewhat cynical practice that the hotel industry had established with their requests for guests to “save the environment” by foregoing daily housekeeping service. Ostensibly this request was framed as a way to conserve water, whereas studies have indicated that the main outcome was a reduction in the labor expenses incurred by hotel managers with very little impact on the actual amount of water used.

Claims around sustainable business practices have more recently been criticized by many as a kind of “virtue signaling.” Expedia Group Inc. Chairman Barry Diller recently disparaged ESG principles in corporate decision-making, claiming that many of these initiatives “just produce glossy reports.” While singling out the efforts of Blackrock’s CEO Larry Fink as being particularly effective in promoting strong sustainable practices, Diller characterized most corporate initiatives in this realm as “empty calories.”

The prevalence of greenwashing seems to be driven by the success of such practices. Studies have indicated that consumers in particular are willing to pay premiums for products or services with a “green” wrapper. However, there is a real risk that the perception of “greenwashing,” whether accurate or not, could have serious financial, legal, and regulatory consequences.

Regulatory Environment

Issuers are particularly concerned about greenwashing accusations surrounding their issuance of securities. Most market participants have stated that the best way to avoid accusations of greenwashing, legitimate or otherwise, is for the relevant capital markets regulators in each economic venue around the world to establish guidance through the passage of regulations specifically creating appropriate ESG disclosure elements and frameworks that issuers can adopt. These frameworks would hopefully be created in a coordinated effort to ensure that the disclosure requirements were harmonized in different countries and regions.

While regulatory guidance in Europe is well advanced, similar efforts in the US are lagging, and most of these initiatives are proposals that have not yet been formally adopted. The following section gives a brief overview of regulations that most directly affect issuers of sustainable/ESG/impact securities.

Sustainable Regulations in the European Union

The Non-Financial Reporting Directive – The NFRD has two main purposes: the requirement to make available non-financial information to stakeholders and investors to determine the companies’ value creation and risks, and to encourage society to take responsibility for social and environmental concerns. The NFRD has been in effect since 2018 and applies to listed and large public interest companies with more than 500 employees, which have either a balance sheet total of more than EUR20 million or a net turnover of more than EUR40 million.

The EU Taxonomy Regulation – This regulation became effective in the EU in July 2020 and created a classification system listing environmentally sustainable economic activities. The Taxonomy Regulation established six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

The Taxonomy is a transparency tool that will introduce mandatory disclosure obligations on some companies and investors, requiring them to disclose their share of Taxonomy-aligned activities. This disclosure will enable better comparisons of companies and investment portfolios regarding sustainability impacts. In addition, it can guide market participants in their investment decisions.

Corporate Sustainability Reporting Directive – The purpose of the CSRD is to revise and strengthen the existing requirements of the NFRD to ensure that companies report reliable and comparable sustainability information that investors and other stakeholders need. Full implementation is expected by year-end 2023.

Sustainable Regulations in the US

Enhancement and Standardization of Climate-Related Disclosures for Investors – The Securities and Exchange Commission proposed rule amendments in March 2022 that would require a domestic or foreign registrant to include certain climate-related information in its registration statements and periodic reports, such as on Form 10-K, including:

- Climate-related risks and their actual or likely material impacts on the registrant’s business, strategy, and outlook.

- The registrant’s governance of climate-related risks and relevant risk management processes.

- The registrant’s greenhouse gas (“GHG”) emissions, which, for accelerated and large accelerated filers and with respect to certain emissions, would be subject to assurance.

- Certain climate-related financial statement metrics and related disclosures in a note to its audited financial statements.

- Information about climate-related targets and goals, and transition plan, if any.

ESG Headwinds

In terms of value and new issuance, 2022 has been a challenging year for many ESG securities. The securities issued by energy companies, most often associated with encouraging fossil fuel dependency, have generally performed well given the spike in energy prices driven by supply chain issues and the war in the Ukraine. However, the securities issued by energy companies are usually viewed unfavorably given that these firms are some of the biggest contributors to undesirable climate change. At the same time, the securities issued by technology firms, which are usually thought of has having business models that align well with sustainability, have performed relatively poorly for most of the year.

ESG is also being politicized in this election year. Several “red” states have announced policies that discourage sustainable investment practices. The Texas state comptroller placed BlackRock, UBS, and eight other firms on a list of financial institutions that spurn energy companies, a decision that may affect whether these firms can manage money for the state’s pensions. The state treasurer of West Virginia announced a similar policy for five firms that he believes are discriminating against coal companies. Most recently, the governor of Florida implemented a resolution prohibiting the state’s pension fund managers from prioritizing ESG considerations when investing funds on behalf of retirees.

Future of ESG Issuance

Reflecting many of the issues noted above, Moody’s ESG Solutions recently forecasted that sustainable bond issuance volumes will be roughly flat compared with last year’s total, with around $1 trillion of issuance for the whole of 2022. At an instrument level, the forecast is now for $550 billion of green bonds, $125 billion of social bonds, $175 billion of sustainability bonds and $150 billion of sustainability-linked bonds by the end of 2022.

While these forecasts reflect diminished expectations from those that prevailed early in 2022, it is clear that the need for climate risk mitigation, accelerating trends in decarbonization efforts to achieve net zero greenhouse gas emission goals by corporate issuers, and increasing regulatory focus on sustainability will generate strong support for the issuance of sustainable securities over the long term. In a positive development for ESG and sustainability, the passage of the Inflation Reduction Act by the Biden administration will provide more than $360 billion to address climate change. The law includes provisions to tackle global warming by creating incentives to build more solar and wind power, construct buildings that are more energy efficient and programs to assist people in purchasing electric vehicles.

These incentives will support the issuance of additional securities by companies engaged in environmentally sustainable activities with positive social impact. While much work remains to be done, more transparent regulatory guidance on ESG factors and the incentives from various government programs should encourage issuers in the private sector to invest even more in projects that will lead to a greater sustainable and circular economy in the future.

About the Author: Rob McDonough

Rob McDonough is the Director of ESG and Regulatory Initiatives at Angel Oak Capital Advisors, LLC and leads the ESG integration process across the firm’s investment strategies and corporate initiatives. He manages several company-wide projects including the firm’s commitments under the Net Zero Asset Managers Initiative and the UN’s Principles for Responsible Investment. He also coordinates a variety of research and publication activities with a focus on developments in the regulatory environment for financial institutions of all types. Rob is a founding member of Angel Oak’s Diversity, Equity and Inclusion (DEI) Committee and the Community Relations Committee.

He previously led Angel Oak’s financial institution consulting practice, where he managed client engagements which included risk model validations, strategic and regulatory stress testing implementations, and investment portfolio risk and performance assessments. Rob was Angel Oak’s Chief Risk Officer from 2012-2014 and initiated the organization’s enterprise-wide risk management framework and SEC compliance program. He also served in the Federal Reserve System for 12 years, first as an Economic Analyst in the Research Division and later as a Capital Markets Examiner in Supervision and Regulation.

Rob is a charter member of the United Nations Principles for Responsible Investing (PRI) Structured Products Advisory Committee, the Structured Finance Association’s ESG Task Force Steering Committee, and chairs the Fixed Income Investor Network’s (FIIN) ESG Task Force.

Rob earned an MBA with a dual major in Finance and Economics from Georgia State University and a BBA from Emory University.

Copyright © 2022 by Global Financial Markets Institute, Inc.

23 Maytime Court

Jericho, NY 11753

+1 516 935 0923

www.GFMI.com

Download article My Cart

My Cart