Two Sides of the Same Coin

Let’s imagine you play a game of Roulette at a Casino. You stand at the table and see there are two blocks, one red and one black. You ask the dealer and she explains to you that this game pays out even odds, in other words, 1:1. If you put $10 on the black and the Roulette ball falls and settles on any black number, then the Casino will not only return your original $10, but also pay you an additional $10 for picking the correct color.

Now, remember that the Roulette Ball itself does not keep track of which color it landed on during the previous spin, and as such, the next spin of the wheel has an equal chance (let’s make it easy and say 50%–50%) of landing on either black or red again. This process can be summed up as a random process with no memory of the prior events. In other words each spin of the wheel is a single event in isolation, without regard of what has happened on the prior 1 or even 100 spins.

How Random is Random Really?

However, we all know that the law of large numbers will force a game with 50–50 odds to have the ball land roughly an equal amount of times on red as it does on black. But here is the crux: this is only true on a large enough sample size—in other words, a large number of spins. The sequence in which these events occur is not at all fixed.

What I mean by that is the ball does not conveniently land on red then on black then on red again. To the contrary, the ball can land on red a number of times before ever landing on black again. As an example, we could easily see seven consecutive spins of the Roulette wheel alllanding on red.

So let me ask you this then: in a case such as this where the ball has landed on red for seven consecutive times in a row, don’t you think one would start to expect the next roll to land on black? After all, the law of large numbers suggests this, right? So by this time, it is not uncommon for us to start placing our money on the black box as certainly in our minds, the probability of the next roll being black has increased.

But has it?

The short answer is no. Recall that the ball does not remember which color it landed on before, so arguably the next roll has an equal likelihood of landing on black as it does on red. So if we only had ten spins on the wheel, you can see how randomness really is not that random for us. The sequence of the events has full power to destroy us (or our capital) long before the law of averages kicks in! If we have unlimited funds and unlimited tries on the wheel, you will also see that we will be able to ride out the period of reds only to then go through a period of blacks, so that over a large enough sample size, and in a game of even odds, the ball will fall on each color roughly an equal number of times when looking at the total sample size holistically.

At this point, though, you would still be comfortable playing the game of Roulette as you feel a sense of equal odds of making some money. At worst, you would have some spent money on a fun and enjoyable evening.

But What if We Changed the Game a Little?

Assume you are at the same table, and the prior seven spins all landed on red. What if the pit boss comes over and now says that the odds are no longer even (i.e., 1:1). Should you bet on black from this point forward, for every $1 you bet, the Casino now only pays out $0.80? All of us (including the casino) are now anticipating black to come up soon. The Casino has therefore adjusted its pay-out ratio given the new information and probability.

What if this process continues? In other words, for every subsequent spin of the wheel that does not fall on black, the pay-out is reduced even more, let’s say eventually ending up at paying out only $0.30 for every $1 you risk (this as a result of the fact that every time it falls on red yet again, in our minds, it increases the expectation that the next roll will land on black).

Would you still play this game? I guess not!

In a nutshell, this is how Binary Options work. In its most fundamental form, it is priced in accordance to the likelihood of the event occurring, auto-adjusting the price vs pay-out relationship as events unfold.

As a very basic summary, the higher the premium you pay for a Binary, the more likely it is that your binary will return the desired outcome. As an example, paying $80 premium for a specific event to occur and then only getting a total pay-out in return of $100 (i.e., $20 more than the $80 risked). Conversely, if you only pay $20 for a Binary that has a potential pay-out of $100, you should be aware that the likelihood of the event occurring is relatively low.

So it becomes easy to see how one can then compare this to the Roulette wheel that auto-adjusts the pay-outs to be less and less, the greater the chance becomes of the event occurring.

Yet, even though we all agreed we would in all likelihood not play the Roulette game in this instance, I find it fascinating how retail investors in particular flock towards Binary Options.

Application Disclaimer of Derivatives

At this point it think it is important to share the following disclaimer. Let me be very clear, I lovederivatives! In fact I have spent the last 14 years solely focusing on derivatives. In the correct hands they can yield marvelous results and extremely efficient risk adjusted returns—though one needs to understand its use in application in order to reduce risk. Binary Options have a very usefuland specific function which we all could benefit from when applied correctly.

It is perhaps also an opportune time to define which activity we are addressing here in particular. When it comes to activity in the financial markets there generally are four broad concepts:

- Investor—Someone looking for long term capital growth (and often lower portfolio risk levels).

- Trader—Someone looking to profit from market movements. Here though it is important to understand that the activity of trading is not risky as in most cases, sound risk management protocols are adhered to. As an example, hardly any professional trader I know will blindly enter a position without at least having studied charts, fundamentals or both. In addition, with every entry there is a known exit point already, thereby knowing exactly how much money is at stake on the trade.

- Speculator—Someone who is not in the business of holding positions for a long time (like a trend trader for example) but whose sole motive is to quickly capitalize on any momentary mispricing that may exist, or based on an anticipated market reaction to an external event. Here too, given the risky nature of these trades, speculators use very sound risk management (i.e., stop loss) triggers to preserve capital, and never risk much on any single trade.

- Trading Gamblers—In theory someone who is only in it for the rush of the possible big ticket. No regard to risk management or market sentiment or analysis. The “go big or go home” crowd.

At the risk of generalizing, it has been my observation that most non-professional Binary Options traders fall into the last category, yet will spend hours trying to convince you otherwise!

Flavor of the Month

The trading of Binary Options is fast becoming mainstream, though not without a dark cloud of mystery, fraud and deception in its past. On the 6th of June 2013, the SEC issued an Investor Alert stating the following:

The SEC’s Office of Investor Education and Advocacy and the Commodity Futures Trading Commission’s Office of Consumer Outreach (CFTC) are issuing this Investor Alert to warn investors about fraudulent promotion schemes involving binary options and binary options trading platforms. These schemes allegedly involve, among other things, the refusal to credit customer accounts or reimburse funds to customers, identity theft, and manipulation of software to generate losing trades.1

Binary Options, like most exotic instruments, started their trading life on the OTC market—in other words, privately between one counterparty and another. However, as their popularity and use became known there was a clear drive to add Binary Options to the suite of products available to every-day investors.

In 2007, the Options Clearing Corporationproposed a rule change to allow binary options, and the Securities and Exchange Commissionapproved listing cash-or-nothing binary options in 2008. In May 2008, the American Stock Exchange(Amex) launched exchange-traded European cash-or-nothing binary options, and the Chicago Board Options Exchange(CBOE) followed in June 2008. The standardization of binary options allows them to be exchange-traded with continuous quotations.2

The question remains though, can US residents and citizens trade Binary Options freely? The short answer is yes, given two qualifying criteria. The North American Derivatives Exchange (Nadex) points out that Binary Options are indeed legal in the US provided that they are listed on a proper United States exchange and that the firms offering them are properly registered and regulated to offer these types of contracts to residents of the United States.3

What Exactly is a Binary Option?

The first thing to understand is that it is not really an option at all. There is a fixed pay-out that will occur depending on the outcome of the trade. This pay-out will be onlyone of two outcomes, hence the termbinary. The trade will pay out zero, or alternatively the face value of the Binary Option (usually $100 per contract). It is important to understand that at maturity of the Binary Option, there is no other outcome whatsoever!

How does it work exactly?

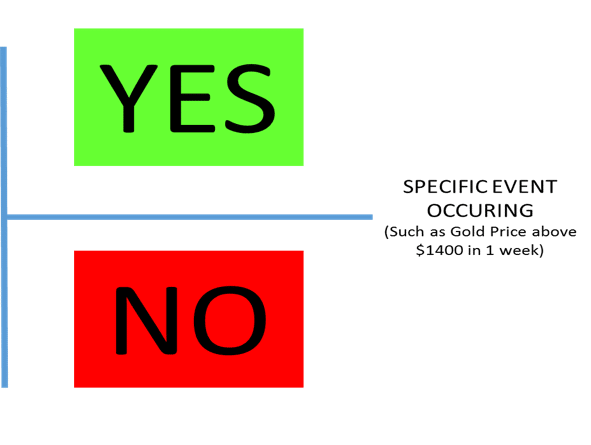

There are two sides to every Binary Option: one party who thinks a specific event will occur (the Buyer), and another who thinks the event will not occur (the Seller). An event can be anything from specifying a price of gold being above or below a certain level, to predicting the estimated Jobless Claims number. Binary Options have a specific time and date at which the underlying market rate (or event) is observed and then compared to the Binary. These can range from intra-day, out to a few months.

In summary then, as far as retail Binary Options go (at least the ones listed on Nadex4), they follow a very simple principle along the lines of the following:

If you think the event will occur, then buy the Binary Option

If you think the event will NOT occur, then sell the Binary Option

To explain this in a bit more detail, the Buyer paysa premium, in the anticipation of the event occurring, and if correct, will bank a maximum pay-out of $100 per contract traded. If the event does not occur, the Buyer gets nothing and forfeits the premium paid (thus maximum risk is the premium outlay).

The Seller receivesthis premium, in the anticipation of the event not occurring, and if the seller is correct and the event does not occur, the seller keeps all the premium. If however the seller is incorrect, and the event did in fact occur, the seller will be obligated to pay $100 per contract (i.e., can lose more than the original premium received, up to a total maximum pay-out of $100 per contract).

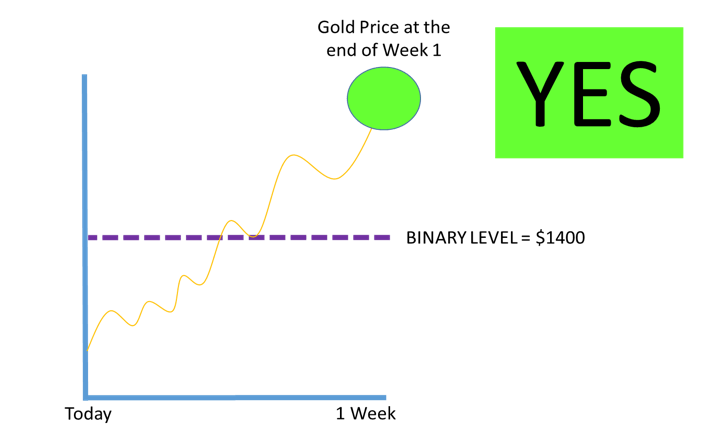

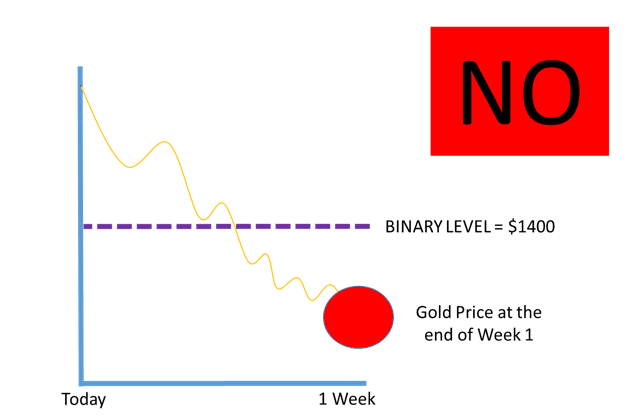

Let’s look at an example (NOTE: I am simplifying the example for ease of reference, in reality Binary Options usually have set expiration dates and strikes):

You expect the gold price to be above (greater) than $1400 in a week from now. In this instance, you will go and buya Binary Option with an expiration date one week from now, at a contract rate (strike) of $1400. Let’s assume the premium you pay is $40.

You will be a Buyer of this Binary—spending $40.

In a week from now, the actual price at which gold is trading is compared to the binary level and any one of the following two (binary) pay-off profiles will exist:

Alternative 1: Actual gold price is above $1400

| Buyer of the Binary | Seller of the Binary | |

| Pay-out Received | $100 | $0 |

| Premium | – $40 | + $40 |

| NET RETURN | PROFIT of $60 | LOSS of $60 |

Alternative 2: Actual gold price is below $1400

| Buyer of the Binary | Seller of the Binary | |

| Pay-out Received | $0 | $0 |

| Premium | – $40 | + $40 |

| NET RETURN | LOSS of $40 | PROFIT of $40 |

Looks fairly harmless, right?

At face value, it is easy to see how investors and novice traders can be attracted to Binary Options. After all, it provides both for a fixed risk, as well as a known maximum benefit.

Let’s recap this for each party to a Binary Option trade:

| Buyer of the Binary | Seller of the Binary | |

| Maximum Reward | $100 | Premium Received |

| Maximum Loss | Premium Paid | $100 – Premium Received |

The Devil is in the Details

The most commonly overlooked aspect is the fact that pricing of a Binary Option reflects probability. In other words, no one in their right mind will buy something worth $90, with the possibility of only getting back $100 (for a $10 gain) if the event in question is highly unlikely to occur, right?

One can argue that if both the buyer and seller of a Binary Option are retail clients, then pricing becomes a bit of a guessing game, settling eventually at a level where there is a “willing buyer/willing seller.” This concept, however, becomes lost when one introduces the fact that the prices of Binary Options are shown by either Market Makers themselves (i.e., a single financial institution showing both the buy and the sell leg), or alternatively by aggregating online platforms showing the best bid and ask price from the market. Either way, the price of a binary is not random.

For financial contracts, it is not that difficult to synthetically create them using other financial instruments. Binary Options on currencies, as an example, can often be reconstructed by using a combination of barrier Calls and Puts. On equities this can often be replicated using In-The-Money Vertical Spreads.5,6

One can thus understand that the Binary Option market will remain somewhat in check, given that the price action between the different markets, for example the barrier options markets and binary options, will prevent arbitrage opportunities to exist for too long a period.

Arbitrage refers to making an almostrisk free profit, via the simultaneous buying and selling of instruments, with similar pay-off profiles. Note the phrase similar pay-off profiles, which does not imply the instruments creating the profile has to be the same.

Why All This Background?

The point being, the market makers of Binary Option prices are all professional counterparties, and as such will follow pricing models based on probability. So back to our Roulette game from earlier—the more likely the event occurring, the higher the price the Market Maker will charge for the Binary. The less likely the event, the cheaper the option.

As an investor or trader then, entering this market may appear to be lucrative given the small premium to pay relative to the possible outcome. This thought however is not checked against the reality of how likely it will be to actually get a pay-out.

Institutions are often asked to guide their clients towards an ideal investment product or class, which in general, follows the age old mantra of a well balanced portfolio consisting of diversified and non-correlating assets.

Why exactly? Time has taught us the valuable lesson of preserving capital while improving our odds for favorable returns. In other words, in volatile markets our portfolio should not lose a lot when negative and stand to gain considerably should markets be in our favor. The aim thus being to lose a little when you do, but make a reasonable return when the markets are in your favor.

Let’s dig deeper and evaluate the motives for using a binary trade, in comparison to the typical reasons other market participants will enter any particular trade or market.

Given its relatively short-term nature, an investor looking for long term capital growth will most likely not use Binary Options, so the only two groups to compare with would be the Traders and Speculators.

When it comes to trading and speculating, the harsh reality is that the amount of losing trades far outnumber the amount of winning trades. This is not a statistic to be afraid of when using proper risk management. The reason being is that a second statistic needs to be read into the same equation. With proper risk management, losing trades lose a smaller amount than what is gained on winning trades.

Let’s just clarify that for a second. The point here is the following: given that one expects losing trades to happen, yet capping the maximum amount lost per trade, allows traders the ability to “let their profits run” on winning trades. The net result collectively is that the amount of profitable trades, though smaller in frequency, generates far more profit than the combined losses of the unsuccessful trades.

So you see, both traders and speculators plan on losing trades. Losing is part of winning, but only when viewed on the premise of solid risk management.

So throwing your money behind Binary Options negates this premise. Not only does the price you pay reflect probability, thereby already disabling the risk reward process, but even when you are right, your profit is capped at a maximum amount per contract.

To put it simply, if you spend $20 on four losing trades and win the fifth trade, you are only back to being at par—hardly a profitable system and even worse when looking at risk adjusted return percentages. This is a hard way to consistently be profitable, and as such, one can agree this no longer is an investment or trading strategy, but sits squarely in the category of gambling or playing the lotto.

Not to say it’s wrong. In fact, to each his own, just as long as you clearly define the motives behind the trade and not try to sugarcoat it as a sound investment principle.

So Are Binary Options Useless Then?

Contrary to what they offer when used outright as a predictor of events or markets, Binary Options can be extremely useful when used for the correct purpose. This article is not meant to go into great detail on any specific trading strategies so the focus will cover their use in concept.

Binary Options allows for institutions to offer its clients a whole suite of new alternatives and a vast variety of non-traditional products. This could often be the key differentiator between the success of one institution and the next. Given the advances in technology and risk management, institutions can even provide solutions in the form of vanilla structured securities or investments.

As an example, by slightly changing the construction of a particular product, due to it being tied to some form of Binary Pay-out can make the product appear remarkably different, and create very profitable pay-off profiles, at least to the extent of attracting a whole new set of different clients (or at minimum retaining existing clients no longer shopping around).

Here are a few productive applications for Binary Options:

Contingent Premium Vanilla Options:Imagine the current price for a normal vanilla option is 5% premium. Imagine too that I can give you an option that has the following premium structure: Zero Premium if you don’t use the option and 9% Premium if you do. Huh? In essence we have just created an option where you don’t have to pay anypremium up front at all; in fact, if the option expires you don’t ever have to pay a premium! That is crazy. In this case, the option’s premium will only be payable should the option be exercised, i.e., In-The-Money. This will be when your option’s contract rate is better than where the market is trading at that time.

Yield Enhancement: Binary Options are often used as part of money market trades, as a yield pick-up based on underlying events. As an example one can construct a deposit where the deposit itself yields 0% (worst case) if a pre-determined event does occur, or at an enhanced rate (better than current equivalent market yields) should the event not occur. Important to note here is there is no risk to capital at all; in fact, at worst you will have a deposit yielding 0% interest.

General Portfolio Wing Protection:Imagine you own stocks in your 401(k) and you get nervous about the market possibly going lower. One can effectively then spend premium to buy fairly low probability Binary Options as an example of portfolio insurance. In this instance should the market drop far enough to reach your Binary, it will kick in an immediate amount of cash right away. This often is enough to ensure your portfolio’s % earnings follow a far smoother profile, and now allow some time for the market to come back to current levels, without your portfolio sitting with a bloody nose.

Summary

It is important to view Binary Options in the correct light. It has fantastic features which, when applied correctly, can add tremendous value. Yet as a standalone investment strategy is far too risky for the average investor with limited capital and, more importantly, limited ability to consistently stomach negative returns.

For the average client, being successful with Binary Options then more closely represents luck being on your side, than being the successful at investing. One should look at risk adjusted returns and apply capital in vehicles or instruments that are skewed in your favor.

References

- http://investor.gov/news-alerts/investor-alerts/investor-alert-binary-options-fraud#.U8WAVU1OX4g

- http://en.wikipedia.org/wiki/Binary_option

- http://www.nadex.com/why-nadex/legal-for-us-residents.html

- http://www.nadex.com/trade-binary-options.html

- http://www.ehow.com/how_4928745_trade-digital-options.html

- http://www.investopedia.com/terms/v/verticalspread.asp

About the Author

Billy Viljoen has over 17 years of financial markets experience, 12 of which he focused predominantly on Foreign Exchange Derivatives. He was head of the FX Structuring desk at Standard Bank (South Africa’s biggest bank) before being appointed to their New York office where he held the title of Head of FX Sales and Structuring. His time spent in New York exposed him to a broad variety of clients ranging from hedge funds looking for trade ideas to capture market anomalies, private investors requiring yield enhancement trades, to multi-national corporates hedging their various FX exposures.

Billy Viljoen has over 17 years of financial markets experience, 12 of which he focused predominantly on Foreign Exchange Derivatives. He was head of the FX Structuring desk at Standard Bank (South Africa’s biggest bank) before being appointed to their New York office where he held the title of Head of FX Sales and Structuring. His time spent in New York exposed him to a broad variety of clients ranging from hedge funds looking for trade ideas to capture market anomalies, private investors requiring yield enhancement trades, to multi-national corporates hedging their various FX exposures.

During the 12 years specializing in foreign exchange he has developed an in-depth knowledge of identifying and managing FX Risk, as well as evaluating the appropriateness of various hedging instruments that are available to mitigate risk. In 2009, he joined Absa Capital (part of the Barclays Group) as a director on the Structured FX desk and was responsible for the bank’s FX Structuring business across South Africa.

He has unparalled dynamic hedging expertise obtained as corporate client advisor and derivative structurer to clients located across Africa, Europe, North America and South America.

After numerous years holding senior positions at banks, Billy resigned to form a Risk Consulting firm where he currently acts as advisor and educator to corporate clients and financial institutions on treasury risk management.

A key component of his current responsibilities includes human capital development. He is often the featured presenter at various public and in-house workshops on topics ranging from Fixed Income, Portfolio Management to Market Risk management. Before returning to the States at the end of 2013, he co-founded and lectured at an educational company offering Level I CFA Preparatory courses. He currently spends significant time in various countries across Africa as a facilitator of ACI Dealing Certificate and ACI Operation Certificate workshops.

Copyright © 2014 by Global Financial Markets Institute, Inc.

Download article My Cart

My Cart