Introduction

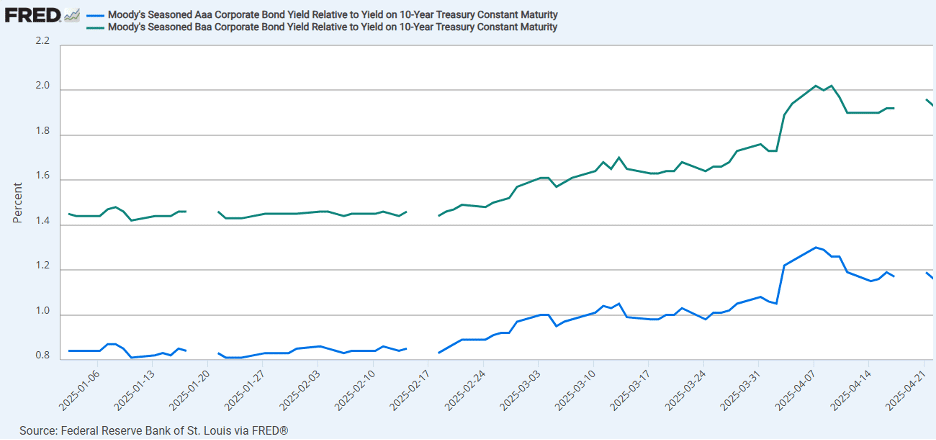

Since the announcement of tariffs, the stock market has been notably volatile. However, the fixed income markets—particularly corporate notes and bonds—have received comparatively less attention. The graph below illustrates the spreads over the 10-year Constant Maturity Treasury (CMT) for bonds rated Aaa and Baa by Moody’s, dating back to the start of 2025. We can observe that investment-grade spreads have widened from approximately 80 basis points to a high of 130 basis points for Aaa-rated bonds, and from around 140 basis points to a high of 202 basis points for Baa-rated bonds.

- Credit Default Swaps (CDS) on single names or credit indexes

- Total Return Swaps (TRS) on single names or credit indexes

- Fixed income Exchange Traded Funds (ETFs)

The new kid on the block is credit index futures. This article introduces credit index futures and explores basic applications using Chicago Mercantile Exchange (CME) contracts.

First a Review of Corporate Bond Risk Factors

Corporate bonds are classified as investment grade (IG), also known as high grade, and non-investment grade, also known as high yield (HY) or junk bonds. The yield can be shown by breaking down the fundamental risk factors for corporate bonds:

T + S = Corporate Bond Yield

Where “T” is the yield on the respective U.S. Treasury, representing interest rate risk, and “S” is the credit spread, capturing credit and liquidity risk.

Credit Index Futures

There are four main credit futures contracts. Two are based on total return indexes for IG and HY bonds. The other two are duration-hedged contracts that isolate the credit spread by removing interest rate exposure using the same indexes.

Futures derive their value from an underlying instrument or index and are standardized. Let’s explore the features of these contracts.

Investment Grade (IG) Futures Contract

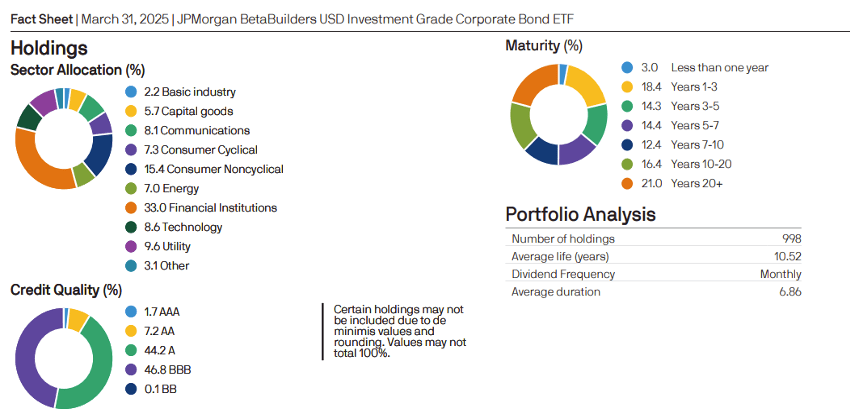

The CME credit index futures contract for investment-grade bonds tracks the Bloomberg U.S. Investment Grade Index1. A comparable ETF is the JPMorgan BetaBuilders USD Investment Grade Bond ETF, which follows a passive strategy for the same index. As of March 31, 2025, the ETF demonstrates broad exposure to the U.S. corporate bond market as shown below:

The contract unit is $30 (this is the multiplier) times the Bloomberg U.S. Corporate Investment Grade Index. For example, if the contract is trading at 3333.00 the contract’s notional value is $30 x 3333.00 or $99,990.00.

The price is quoted in U.S. dollars and cents per index point. The minimum price movement is $0.50 or $15.00. A move from 3333.00 to 3333.50 yields a $15.00 gain per contract. Owning 10 contracts and experiencing a move from 3333.00 to 3336.50 results in a profit of $1,050 (10 contracts x 7 ticks x $15.00).

A Speculative Application

If you anticipate corporate bond yields will decline, you would buy the futures contract. Conversely, if you expect yields to rise, you would sell the contract.

Risk Metrics

Metrics, such as Option-Adjusted Spread (OAS), Option-Adjusted Duration (OAD), and Option-Adjusted Spread Duration (OASD) are available via CME’s Credit Futures Analytics (Credit Futures Analytics – CME Group). For example:

The OAD measures interest rate risk, while the OASD measures credit spread risk. If the Treasury curve shifts by 100 basis points, the price impact on the index is approximately 6.79% of 3305.63, or about 225 index points. These metrics are for the cash index.

If the futures contract is trading at 3312.50, the DV01 (Dollar Value of a 1 basis point move) is calculated as: 6.79 x 3312.50 x 30 x 0.0001 = $67.48.

Note: Futures prices above come from CME Credit Futures Analytics. The futures contract OAD is assumed to match the index. Technically there will be a difference, which is referred to as the basis, between the two prices and, therefore, the OAD would be different.

High Yield (HY) Index Futures Contract

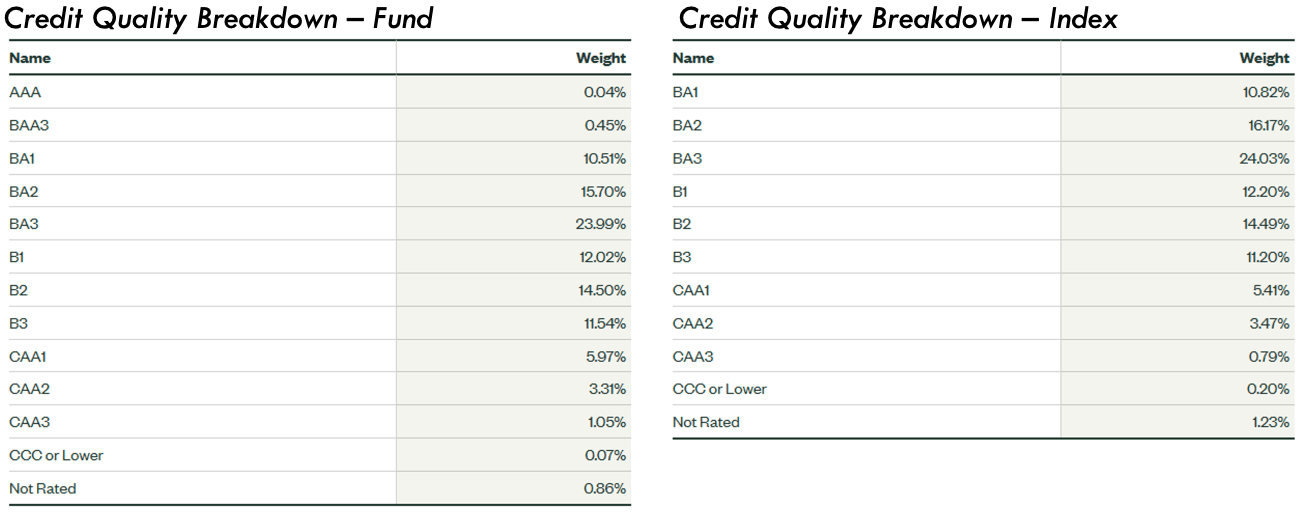

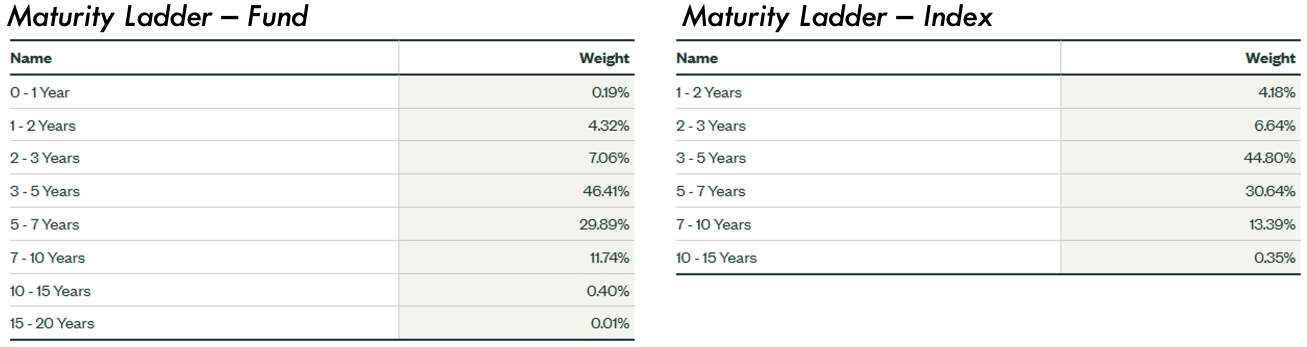

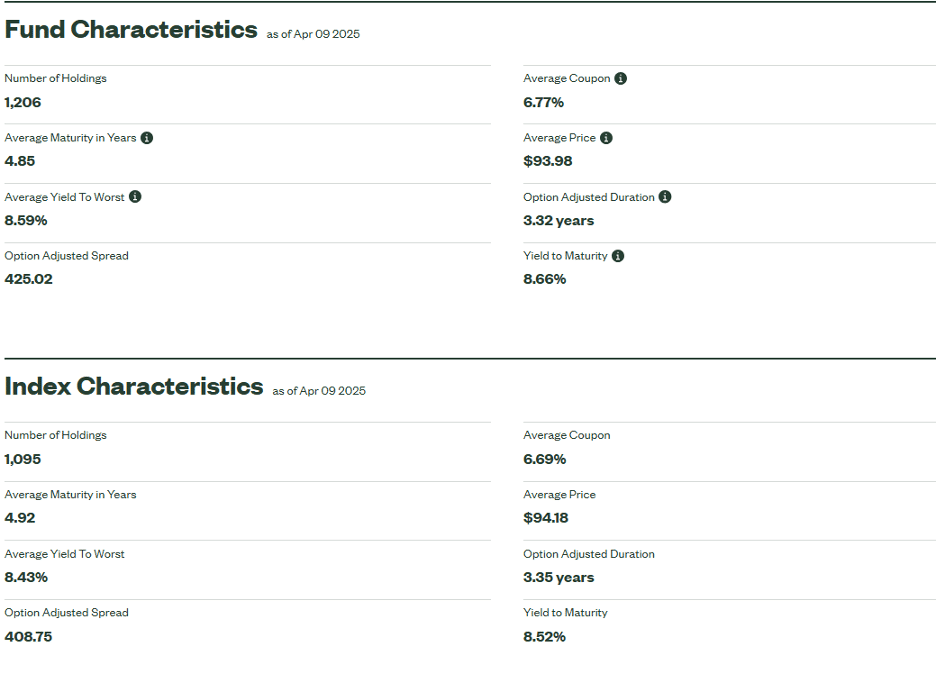

The CME high yield contract tracks the Bloomberg High Yield Very Liquid Index1. The SPDR Bloomberg High Yield Bond ETF is a comparable fund, although it uses a sampling strategy rather than holding the full index2. For our purposes, the ETF sufficiently illustrates index features.

As of April 8, 2025:

The HY Credit Index Futures Contract

HY Contract Specifications:

- Unit: $150 times the Bloomberg HY Index

- Example: 674.00 x $150 = $101,100.00 notional value

- Minimum price movement: 0.10 index points = $15.00

If you hold 10 contracts bought at 674.00 and the price rises to 675.20, your profit is: 10 contracts x 12 ticks x $15.00 = $1,800.00.

Speculative Application

Like IG futures, if you forecast a decline in corporate bond yields, you would buy the contract. If you expect yields to rise, you would sell it.

Duration Hedged Futures Contracts

The Duration (Interest Rate) Hedged IG Index (DHB)

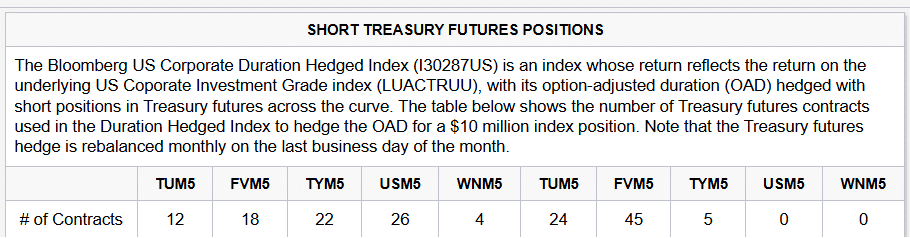

The formula T + S = Corporate Bond Yield is modified by removing the “T” component. This is achieved by selling U.S. Treasury futures across maturity buckets to achieve a duration of zero, isolating the credit spread. Here is the example used by the CME on the Credit Futures Analytics page (Credit Futures Analytics – CME Group):

For all intents and purposes, the end user is transacting on the spread and not the interest rate portion of the corporate bond index.

The DHB Credit Index Futures Contract

· Unit: $500 x Bloomberg U.S. Corporate IG Duration Hedged Index

· Example: 207.00 x $500 = $103,500 notional value

· Minimum price movement: 0.05 index points = $25.00

· If you buy 10 contracts at 207.00 and the price increases to 208.00, the profit is: 10 x 20 ticks x $25.00 = $5,000.00

Speculative Application

This contract allows traders to speculate on credit spreads exclusively. If you expect spreads to narrow, you would buy; if you expect them to widen, you would sell. The key distinction is that this contract focuses solely on credit risk and removes interest rate risk.

There is a duration hedged contract on high yield (DHY) but will leave that for the reader to explore.

Risk Metrics

For duration-hedged contracts, similar to the DV01 contract above, the key metric is CR01 (Credit Risk of a 1 basis point move). Example calculation: 6.80 x 3312.50 x 30 x 0.0001 = $67.58.

These contracts are designed with zero duration, meaning they focus solely on credit spread risk and the corresponding risk measures of CR01 and OASD and not OAD.

Conclusion

Credit index futures contracts provide portfolio managers and traders with tools to gain exposure to either total return or credit spread movements. Investment-grade and high-yield credit index futures are primarily designed to capture total return, whereas duration-hedged credit index futures allow for the isolation and trading of credit spread risk independently from interest rate fluctuations. These instruments enhance portfolio construction flexibility—enabling managers to fine-tune fixed income exposures—while offering traders targeted opportunities to speculate on either total return or credit spread performance.

References

1 For more information regarding the underlying Bloomberg indexes used in the CME credit futures contract go to FAQ: Credit Futures – CME Group

2 For more information on the ETF see the prospectus https://www.ssga.com/us/en/institutional/resources/doc-viewer#jnk&prospectus

About the Author: Ken Kapner

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Download article